[ad_1]

Also in this letter:

■ Zomato seeks higher commissions from restaurants

■ India asks IMF, FSB to prepare technical paper on crypto assets

■ Indian IT, BPM firms see high demand for AI chatbot pilots

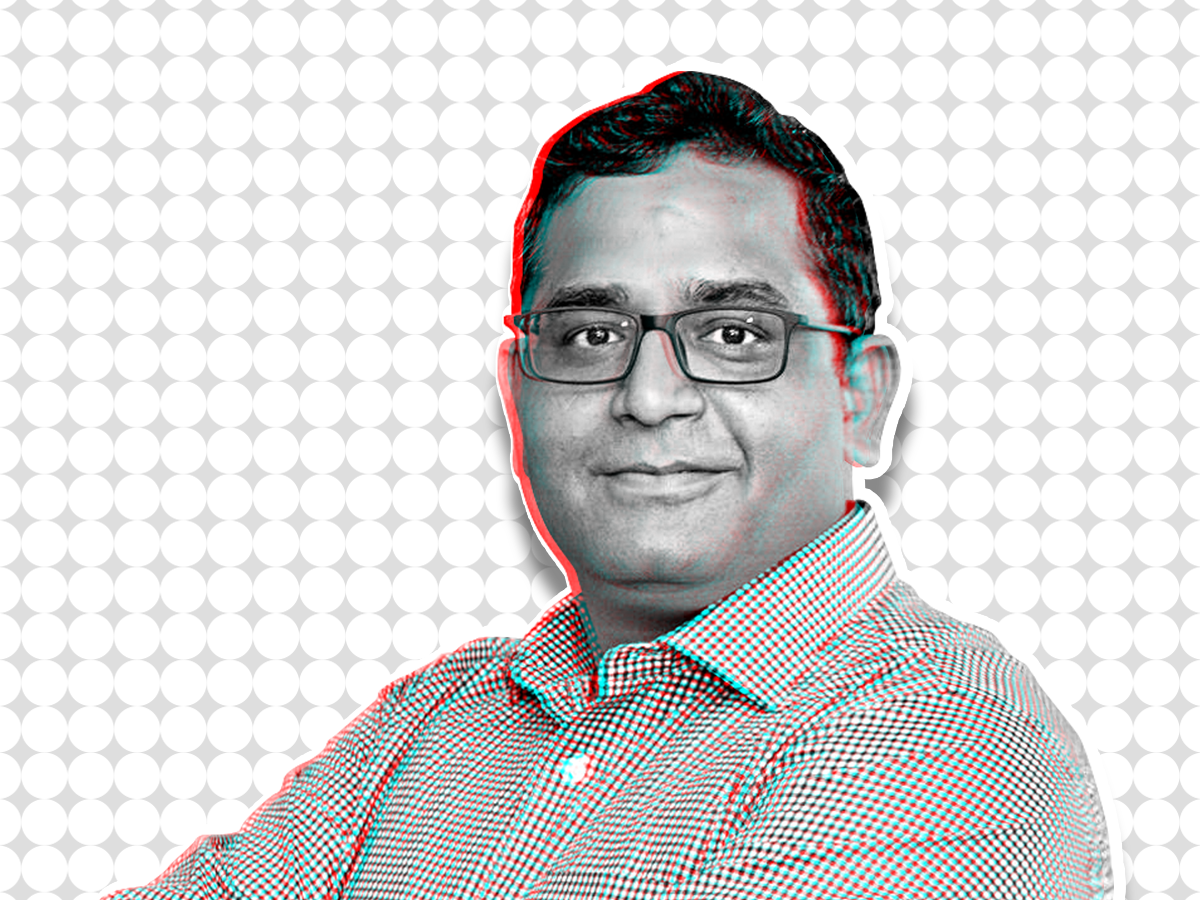

SoftBank, Ant discuss selling Paytm shares

Ant group — an affiliate of Alibaba — and SoftBank, two large investors in Paytm’s parent One97 Communications, have held discussions to lower their holding in the payments firm, sources told us.

Who is buying? The shareholders and the investment banks representing them had earlier approached telecom billionaire Sunil Mittal of Bharti Enterprises and another Indian conglomerate, offering the stake to them. The talks, however, didn’t progress and Bharti is not engaged in conversations on this issue anymore, sources aware of the matter told us.

What’s next? Investors can still offload their shares — in part or full — through open market deals and a ‘strategic’ investor may still buy these shares. A secondary sale to financial investors in the open market through a block deal is still a possibility, sources added.

No strategic investor: Paytm founder and chief executive Vijay Shekhar Sharma, we are told, is not in favour of any strategic investor coming on board through these potential secondary share sales. However, he is okay with financial investors picking up these shares in the open market.

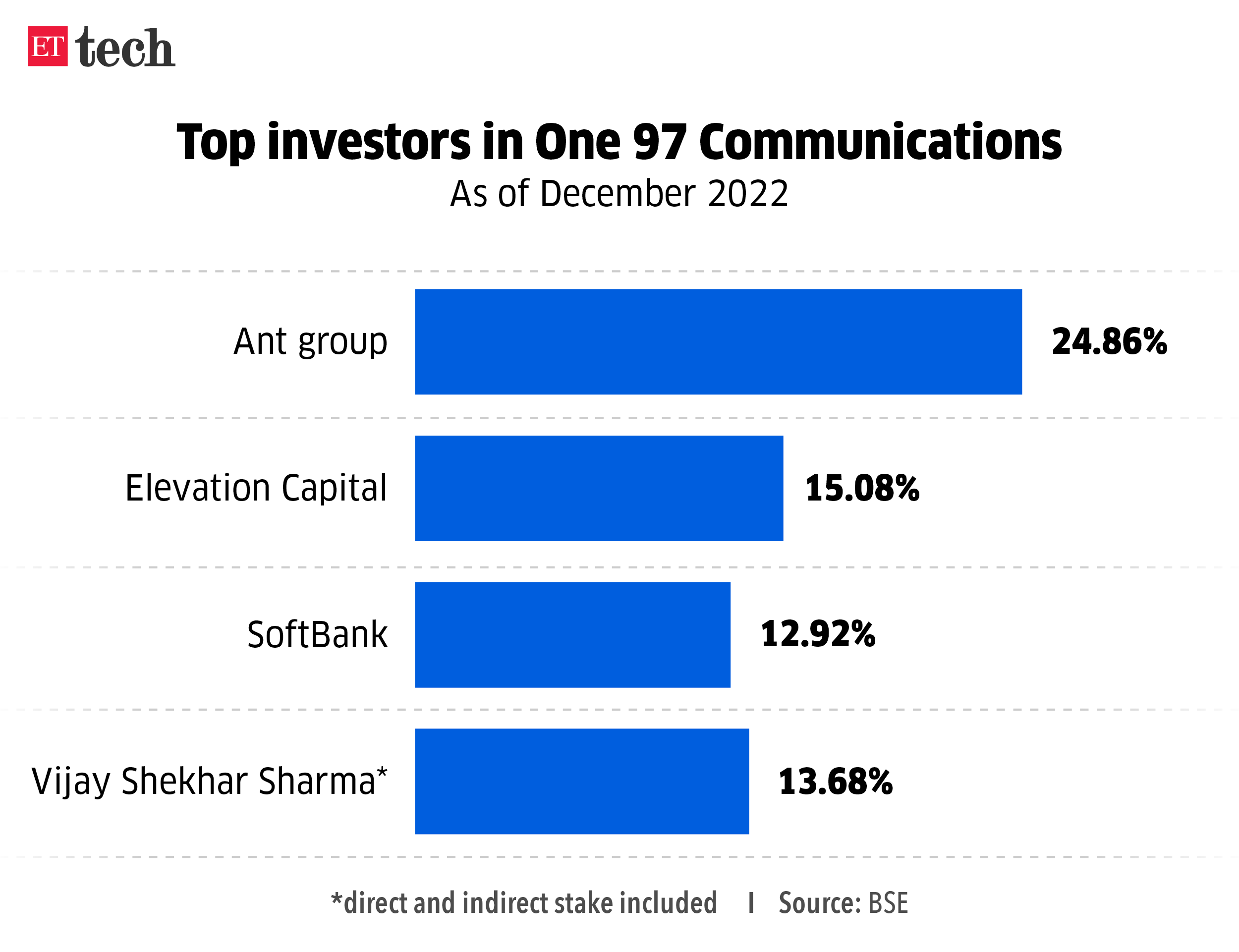

Who owns how much? Jack Ma-founded Alibaba recently exited the fintech firm, but Ant group (formerly Ant Financial) is still the single largest shareholder in the firm with about 25% stake. SoftBank and Elevation Capital own around 13% and 15%, respectively, of the Noida-based fintech firm.

Sharma, himself holds close to 14% of the company. One97’s shareholding pattern will likely change as the company executed a share buyback worth Rs 849.83 crore at an average price of Rs 545.93 per share on February 13.

Exclusive: Zomato asks for higher commission charges; restaurants are upset

Under pressure to turn profitable amid a slowdown in the food delivery business, Zomato is seeking a 2-6% increase in commission charges from its restaurant partners which has triggered a conflict.

Why the hike now? Zomato has been charging a commission of 18-25% per order for deliveries for the past two years, depending on its arrangement with restaurant partners. According to a Zomato spokesperson, the food delivery app keeps reconsidering the commission rate to make sure they are competitive and sustainable for restaurants as well as Zomato.

A restaurant industry executive said Zomato wanted parity with other aggregators like Swiggy.

Restaurants are unhappy: Restaurant partners have not agreed to the Zomato demand. The National Restaurant Association of India (NRAI) president Kabi Suri said the matter will be taken up with Zomato.

An executive at a national restaurant chain, requesting anonymity, said, “Some of us have been told we could be delisted, our delivery radius could be reduced, or visibility could be lowered on the platform, if we don’t adhere to their demand. We have not agreed.”

Why the conflict? Karan Tanna, founder and chief executive of food tech company Ghost Kitchens said it is good to see Zomato’s focus on unit-level profitability, but this might disturb the unit economics of restaurants drastically.

Catch-up quick: Zomato’s move to hike commission rate comes days after the company reported a net loss of Rs 347 crore for the October-December 2022 quarter, wider than the Rs 63.2 crore posted a year earlier. The platform’s revenue rose 75% from a year ago period to Rs 1,948 crore. However, consolidated revenue from operations surged 75% on year to Rs 1,948 crore.

Exclusive: Used-car dealers flag issues as new rules kick in from April

Ahead of the new rules for second-hand vehicle dealers kicking in, ecosystem stakeholders have flagged certain provisions that could potentially impact businesses. The amendments to the central motor vehicle rules, which impact companies like Cars24, Spinny, CarDekho, OLX Cars, among others, become applicable from April 1.

Issues flagged: The government wants second-hand vehicle dealers to get registered. Dealers are also required to mandatorily declare their GST registration.

Secondly, the Centre has introduced the concept of deemed ownership, wherein the authorised dealer will be considered a deemed owner of the vehicle after submission of a form after taking the vehicle from the original owner. This puts the liability of the vehicle including any incidents that happen upon the deemed owner.

The GST conundrum: On the registration aspect, the industry has said that the implementation of this rule could delegitimise a large number of small dealers selling second-hand vehicles across the country. This is because there are several used car dealers, which have turnover much below the prescribed threshold limit required under the GST laws, and hence do not have a GST registration.

Further, the industry has flagged that the rules, while talking about deemed ownership, do not consider the scenario of a dealer selling the vehicle to another dealer—a model that is deployed by auto-tech unicorns.

Quote unquote: Cars24 general counsel Kamal K Avutapalli told ET that 70-80% of the smaller dealers fall below the cut-off for having a GST registration.

“If the smaller dealers don’t get registration, we won’t be able to sell it to them. So, not only do these dealers get impacted, but we as a platform also get impacted because my liquidity of valid dealers is going to get lost.”

Indian IT, BPM firms see high demand for AI chatbot pilots

Companies across IT services and BPM solutions are receiving more and more requests for pilot projects to analyse how generative artificial intelligence (AI) solutions like ChatGPT can be used for enterprise applications, also triggering discussions at their boards, said industry executives.

India’s role: Executives, while speaking to ET at an industry roundtable, said that India, with its huge workforce can create a differentiated offering in this space. Companies like Tech Mahindra, Genpact and Fractal Analytics see high interest in the usage of generative AI for content generation in areas of customer support.

Also read | AI chatbots like Bard, ChatGPT stoke fears of misinformation nightmare

Caveat: For ChatGPT to be useful for businesses and enterprises, the applications need to have a stronger contextual background of the business cases that the enterprise deals with, said Nikhil Malhotra, Tech Mahindra’s chief innovation officer.

India asks IMF, FSB to prepare technical paper on crypto assets

As the current holder of the G20 Presidency, India has assigned the International Monetary Fund (IMF) and the Financial Stability Board (FSB) the responsibility of collaborating to produce a technical paper concerning crypto assets. The aim of this paper will be to assist in creating a unified and thorough policy for the regulation of crypto assets.

The G20 intends to establish a globally recognised framework for regulating crypto assets and has stated that only a currency supported by a central bank would be considered as valid.

Seeking global consensus: The joint paper would be presented at the meeting of finance ministers and central bank governors in October 2023, an official statement said.

The IMF’s discussion paper, the policy seminar and the joint IMF-FSB paper are expected to integrate the policy questions pertaining to macro-financial and regulatory perspectives of crypto assets and facilitate a global consensus on a well-coordinated and comprehensive policy approach to crypto assets, as per the statement.

Quote unquote: “There is wide recognition and acceptance of the fact that cryptocurrency, or asset, or whatever name you call it, is a risk to financial stability, monetary systems and cyber security. There will be a synthesis paper on this whole issue of crypto. That will form the basis to develop an international architecture,” said RBI governor Shaktikanta Das.

Tweet of the day

Other Top Stories By Our Reporters

NCERT starts DIKSHA security audit after data breach reports: After reports of breach of data belonging to the government-run DIKSHA (Digital Infrastructure for Knowledge Sharing) app, the Central Institute of Educational Technology (CIET) told ET that the National Council of Educational Research and Training (NCERT) has initiated a third-party security audit of DIKSHA to further ensure that data remains secure.

Here’s why Noida-based startup LambdaTest drew praise from Microsoft’s Satya Nadella: Of late, a different automation tool – created by a small team of Indian engineers working for LambdaTest – has caught the eye of no less than Microsoft chairperson Satya Nadella. Read here to know why.

We are creating a new science for understanding the work graph: Rohan Murty | Entrepreneur Rohan Murty’s nine-year-old startup Soroco, which started off building an automation tool for workplaces, is turning into a high-growth phase after a pivot few years ago. Read the full interview here.

Global Picks We Are Reading

■ A Basic iPhone Feature Helps Criminals Steal Your Entire Digital Life (WSJ)

■ How Ukraine is beating Russia’s disinformation campaigns (Rest of World)

■ Amazon Has a Donkey Meat Problem (Wired)

Illustration and graphics by Rahul Awasthi

[ad_2]

Source link