[ad_1]

Also in this letter:

■ Sellers revolt as Meesho tightens control on product returns

■ Indian IT firms to face margin crunch in 2023: analysts

■ Focus to be on rewarding and retaining talent, even amid layoffs, say startups

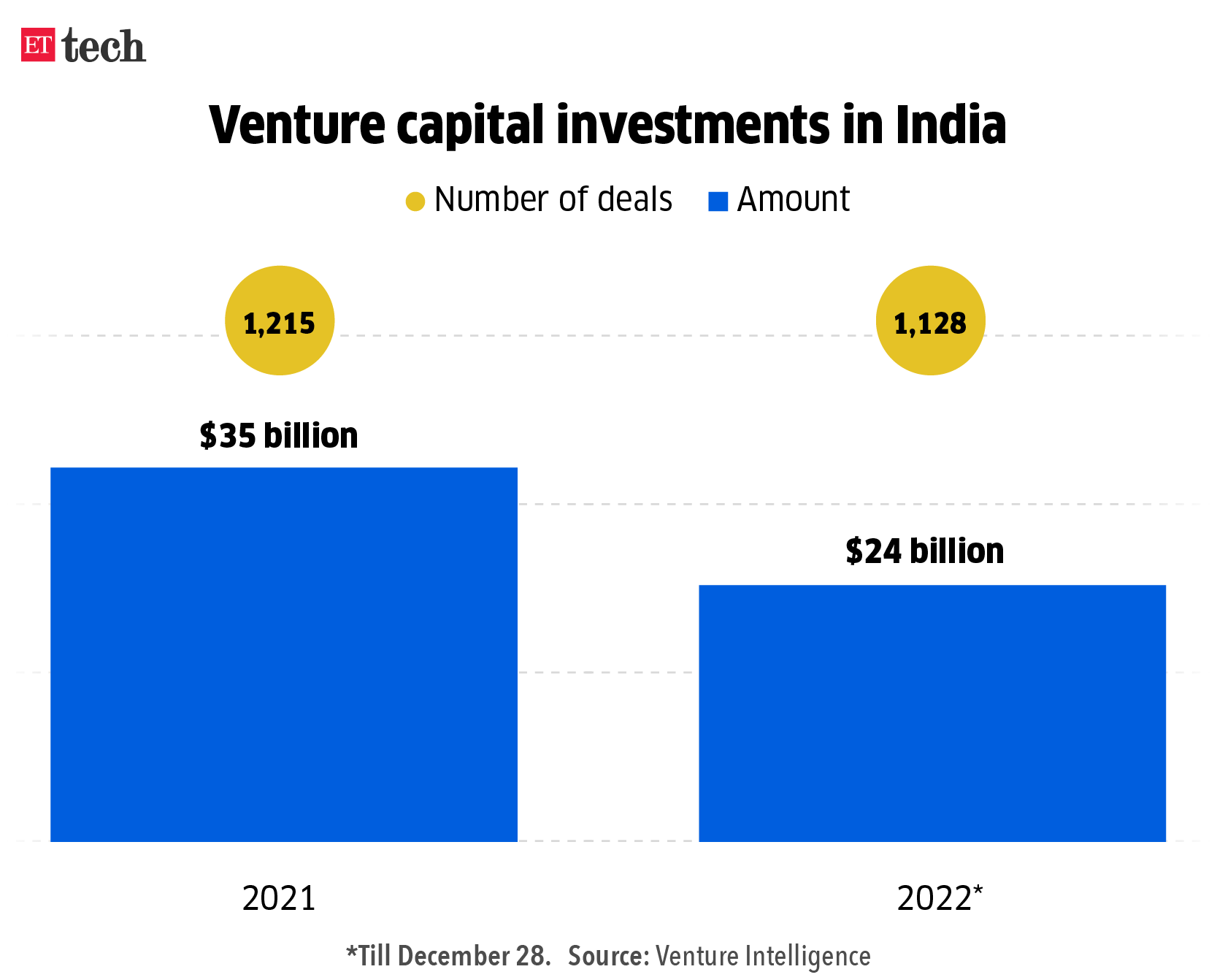

PE, VC investors seek tax parity in union budget

Private equity (PE) and venture capital (VC) investors have sought tax parity in the upcoming budget, saying that a differential tax treatment for listed and unlisted securities is distorting asset allocation decisions.

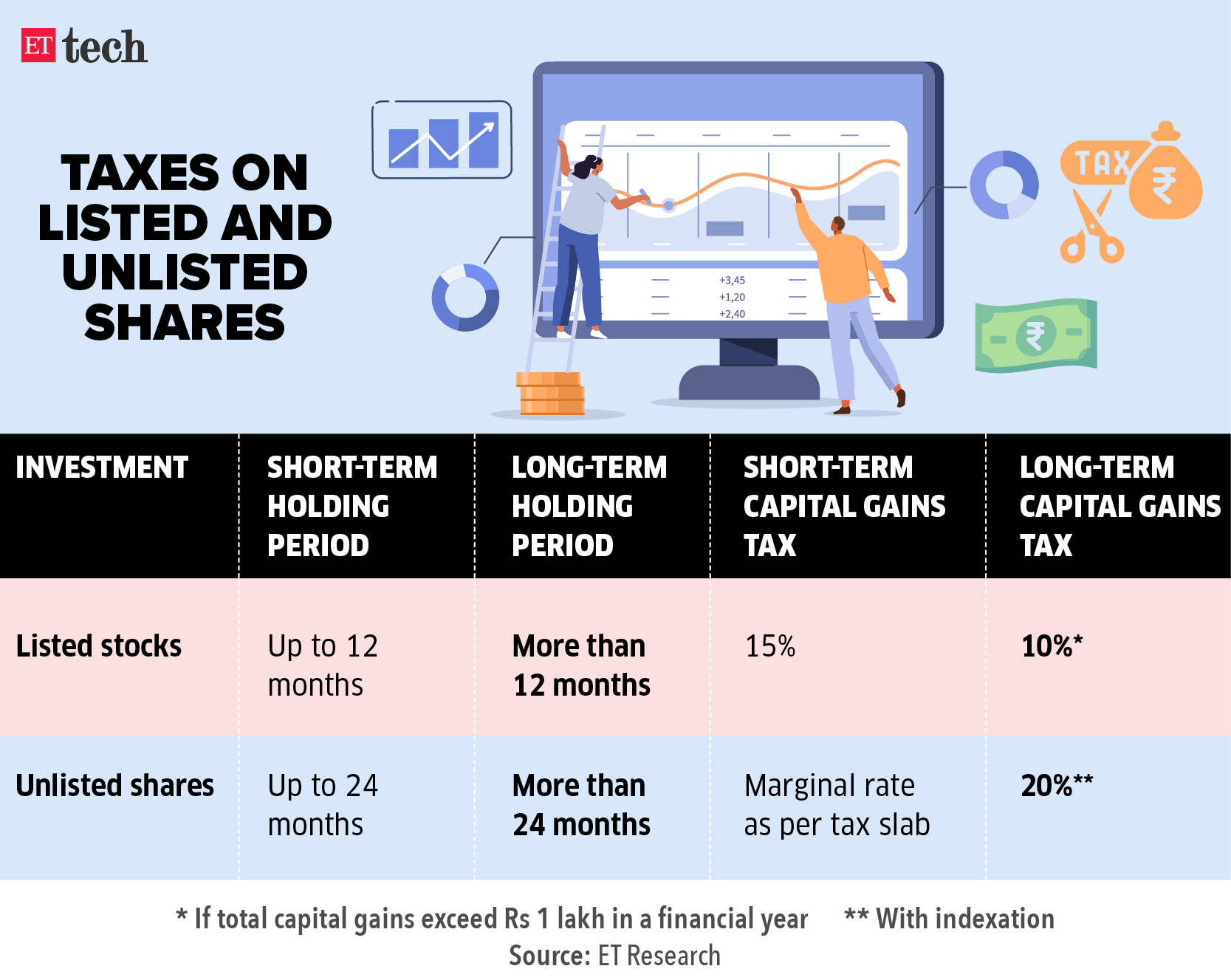

The issue: Currently, listed stocks attract a capital gains tax of 15% on short-term gains (less than 12 months), while unlisted shares attract short-term capital gains tax as per the slab of the investor.

Similarly, gains from listed stocks sold after being held for more than a year attract 10% tax if the capital gains exceed Rs 1 lakh during a financial year, but that on unlisted securities attracts 20% tax. The minimum holding period for unlisted shares to be considered long-term assets is 24 months.

Internet industry body IndiaTech, which represents a clutch of startups and VC investors, also said that the longer holding period for unlisted securities to be considered long-term assets means angel investors have to pay up to four times more tax if they sell a stake in an unlisted company after holding it for 18 months.

Quote: “This asset class (alternative investments) is very foundational in terms of the nature of capital as it’s creating new enterprises, new entrepreneurs, new jobs, and is allowing us to compete on a global stage. It is also very different from public markets capital, where money is changing hands but isn’t fundamentally economy-forming,” said Karthik Reddy of the Indian Venture and Alternate Capital Association (IVCA).

Sellers revolt as Meesho tightens control on product returns

Sellers are up in arms over ecommerce firm Meesho’s move to tighten control on product returns, sources have told us.

What’s going on? Over the past few weeks, these sellers – especially in Surat, one of the largest hubs for fashion and apparel merchants — have given Meesho negative reviews and poor ratings on its app and stopped processing orders through the platform, merchants said.

Changes: Meesho made changes to its product returns policy following feedback from its third-party logistics partners, the sources added, and began implementing thorough checks on returned products at the start of the year.

This followed widespread misuse by sellers of its old return policy, executives from third-party logistics companies told us. Meesho compensates sellers for products returned by customers.

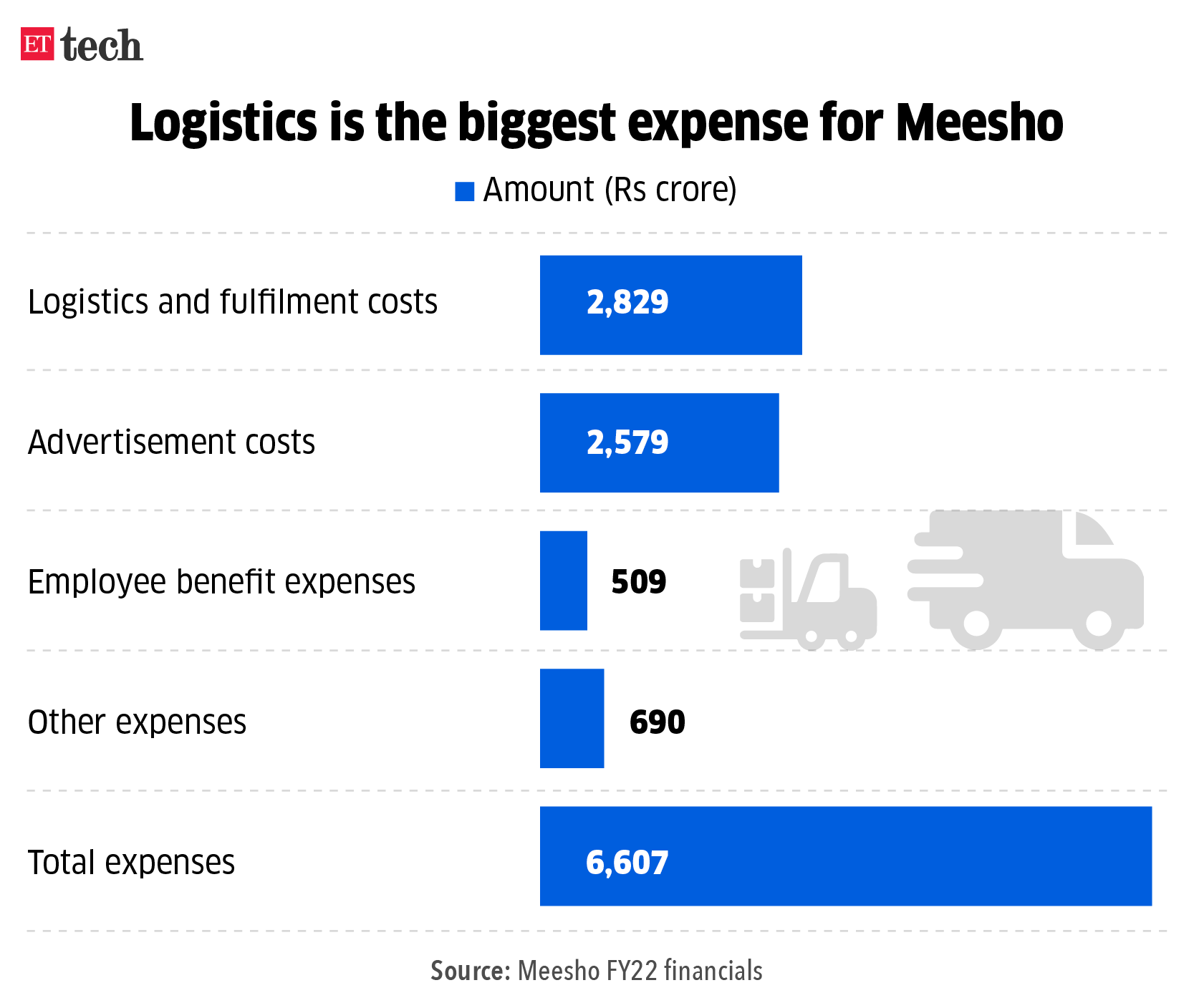

Zoom out: The startup, which specialises in selling low-priced apparel, home and lifestyle items, has streamlined the returns policy at a time when internet firms are cutting costs because of a funding squeeze.

Meesho’s sellers have also seen sales decline after a bump-up during the festive season last year, several merchants told us.

Indian IT firms to face margin crunch in 2023: analysts

India’s top IT service providers Tata Consultancy Services (TCS), Infosys, HCLTech and Wipro will face margin pressure this year in the absence of significant pricing improvement, analysts said, despite lower attrition rates and employee costs going forward.

These software exporters have reported sequential margin growth in the third quarter, with upbeat commentary on near-term margin performance. There is headroom to improve utilisation and automation to increase the effective price of delivery or realisation, they have said.

Recession could hit margins: Though margins have shown a modest rebound, largely driven by increased pricing power, a recession will likely induce more pricing pressure and there may be little room in some key segments to utilise the traditional levers of increased offshoring, pyramid optimisation and automation, said Peter Bendor-Samuel, chief executive of IT research firm Everest Group.

Current margins: TCS, India’s biggest IT company, saw its operating margins expanding by 50 basis points (bps) sequentially to 24.5%. Bengaluru-based Infosys retained its operating margin outlook at 21-22% for the fiscal year, but the company expects to close the year at the lower end of the band.

Similarly, in a seasonally weak quarter, HCLTech reported operating margins of 19.6%, up 160 bps sequentially and 60 bps on year. Fourth-largest Indian IT company Wipro’s quarterly operating margins expanded 120 bps sequentially to 16.3%.

TWEET OF THE DAY

Focus to be on rewarding and retaining talent, even amid layoffs, say startups

Amid continuing layoffs, cost-cutting and a funding slowdown in the startup ecosystem, a bunch of companies including upGrad, NoBroker, EnKash, Zepto, Cashkaro and HomeLane say that despite a challenging external environment, the focus during the upcoming appraisals will be on rewarding and retaining high performers, while keeping all team members motivated.

Esops on the cards: Top talent will be rewarded with Esops, special bonuses, larger roles, trips and faster career progression tracks, founders at these startups told ET.

Overall increments will happen based on organisational growth, achievement of business targets and industry trends. But the appraisals will largely be in line with last year’s at most startup units.

Employee morale: While edtech company upGrad is planning on granting ESOPs worth Rs 100 crore to select employees across levels in the upcoming appraisal cycle, for Cashkaro, both fiscal prudence in the interest of the overall business, and keeping up the overall morale of employees are important.

“Good appraisals are a key part of driving employee motivation. Hence, cutting down on salary increments or employee rewards has never been on our list, and will not be in 2023 as well,” said cofounder Swati Bhargava.

Think9 Consumer in talks to acquire multiple D2C brands

Ashni Biyani, cofounder, Think9

Think9 Consumer, a multi-brand platform promoted by Ashni Biyani, daughter of Future Group chairman Kishore Biyani, is in talks with close to a dozen direct-to-consumer brands across retail, fashion, FMCG, kids furniture, home decor, beauty and ayurveda to co-create them on the lines of Thrasio-styled house of brands businesses, executives aware of the plans said.

This is in addition to existing brands such as Kingdom of White, which sells white coloured shirts, Italian bakery and snacks label Sorrentina, and personal care brand Beauty in Everything (BIE).

Quote: “We are co-creating digital-first brands focusing on high gross margins, high average order value and profitability. Rather than acquiring brands and revenue, we start at the zero-to-one stage, building the brands and business ground up,” said Ashni Biyani, cofounder, Think9.

Think9’s new ventures include Smartsters, a children-development focused home spaces desk and storage space solutions brand, The Good Bug probiotics and Panchamrit, a wellness brand of gummies, multivitamin tablets and strips.

Other Top Stories By Our Reporters

Growth with bumps: a year of margin recovery for IT firms as talent costs normalise: This will be a year of margin recovery for IT firms as upfront talent costs normalise, but whether this is aided by business growth or internal efficiency remains to be seen.

Senior professionals flee startups to safety net of large companies amid layoffs: Startups and new-age digital companies — that were attracting top talent with their accelerated career path and huge wealth creation opportunities until recently — are seeing an exodus of senior professionals who are now seeking the safety net of established companies.

Campus blues: mass layoffs put IITians on edge: A degree of apprehension has crept into elite Indian Institute of Technology campuses that are in the middle of a placement season, triggered by the news of layoffs at a number of recruiters including Amazon, Microsoft, Google and Goldman Sachs.

Global Picks We Are Reading

■ Genesis demise marks end of era for crypto’s pseudo-banks (WSJ)

■ Microsoft’s big bet on AI could bring ChatGPT to the masses (The Washington Post)

■ Indian teenagers from small towns are taking YouTube Shorts by storm (Rest of World)

[ad_2]

Source link