[ad_1]

Even as the winter recedes from the capital, the chilly undercurrent of the funding winter was palpable at the GSV Emeritus India Summit, organised earlier this week at Gurugram, which saw participation from executives representing edtech startups and investors from across the country and overseas.

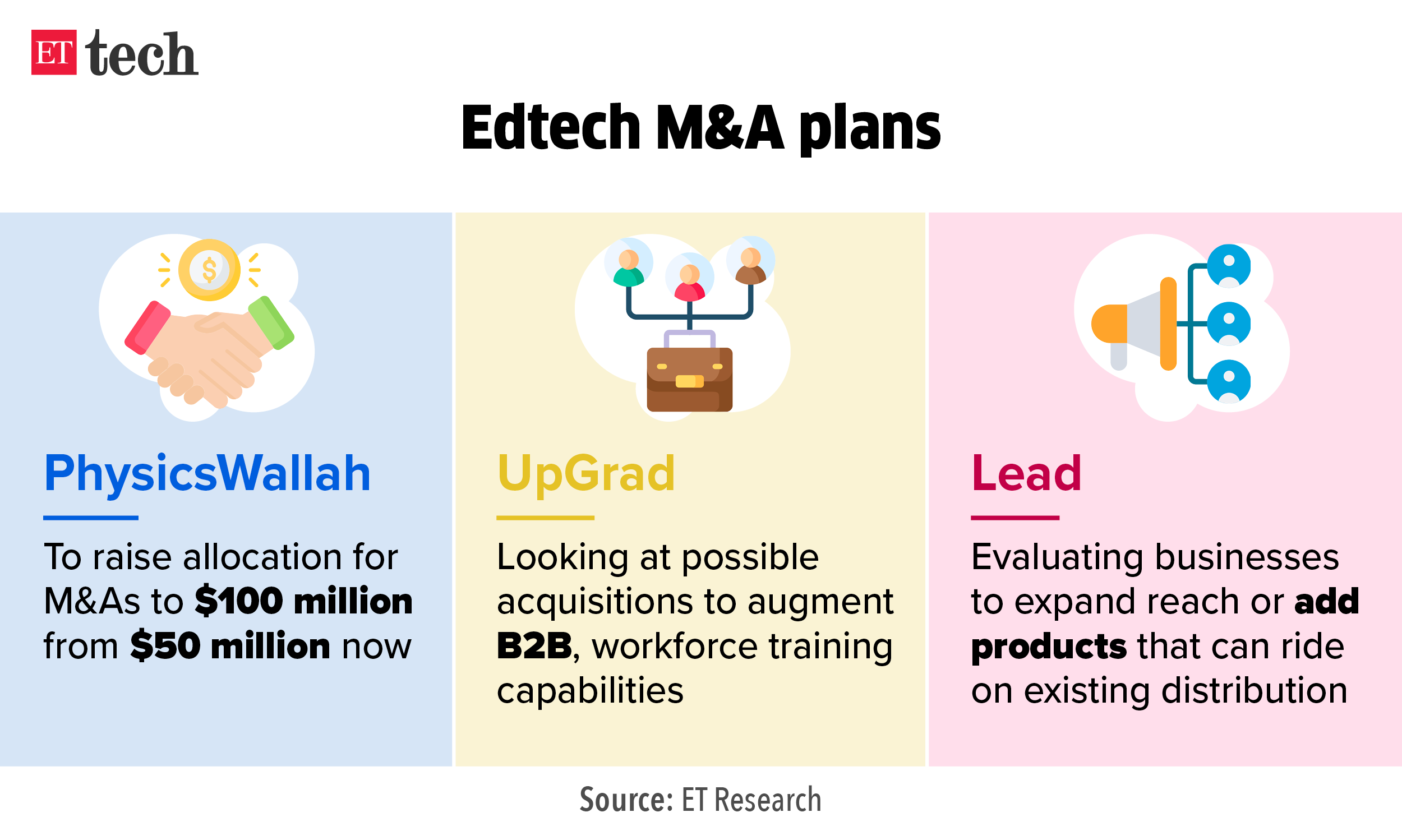

While the on-stage discussions were on topics such as the use of immersive tech, evolving models of edtech, innovation and employability, potential merger and acquisition deals grabbed the limelight in all off-stage discussions, underscoring the current thinking of key founders and investors in the space.

From a cofounder of an edtech unicorn rescheduling his flights to sit with executives of potential target companies to investment bankers carrying folders with pitch documents of startups wanting to get bought out, the common theme emerged was: cash is king.

What’s the context? Earlier this week, we reported that large startups in the edtech space that are sitting on cash piles are starting to poach potential targets.

While PhysicsWallah is planning to increase allocation for M&As to $100 million, UpGrad is looking at possible acquisitions to add to its B2B and Lead is evaluating businesses that expand its reach.

A key facet of those wanting to offload stake was that they did not want equity-swap deals, which highlights the importance of cash in the current environment.

Edtech winter: While the overall funding slowed down for startups, edtech firms bore the brunt. Edtech startups received $3.1 billion in venture funding in 2022 compared to $5.4 billion in 2021, a drop of over 42%, according to Tracxn.

Well-funded edtech firms – Byju’s Unacademy and Vedantu–together fired at least 6,000 employees last year.

What are the leaders saying? PhysicsWallah cofounder Prateek Maheshwari told us: “We originally allocated $20 million, and then stretched it to $50 million. We are rethinking this number again. In my view, we should be using the entire $100 million for acquisitions but (PhysicsWallah founder and CEO) Alakh (Pandey) needs to approve, the board needs to approve, so we’ll see.”

Cash-rich edtech firms out to poach rivals in funding winter: Large edtech startups are looking to deploy their huge piles of cash towards acquiring potential targets, founders and analysts told us. The funding crunch has made these startups prune costs under different heads.

ETtech Exclusives

Lenskart eyeing to raise $100 million from ChrysCapital: Omni-channel eyewear retailer Lenskart is in talks with ChrysCapital to raise $100 million, people aware of the matter told us. If the deal closes, it would be among the largest investments in a new-age entity by ChrysCapital.

RoC seeks MCA nod to examine books of GoMechanic: Amid allegations of financial irregularities at Targetone Innovations Private Limited, the parent of troubled car-serving startup GoMechanic, the Registrar of Companies (RoC) has proposed examining its books. Last month, co-founder Amit Bhasin admitted to grave errors in the company’s financial reporting and confirmed that the company would fire roughly 70% of its employees.

Looking for the right match, Match swipes right on Shaadi: American technology firm Match Group is in advanced talks with Shaadi.com for a strategic investment in the Indian company. “Over the past month, Match Group and Shaadi.com have had a few rounds of strategic discussions and are in the final stage of discussions where finances are being discussed,” a source told us.

ETtech Interviews

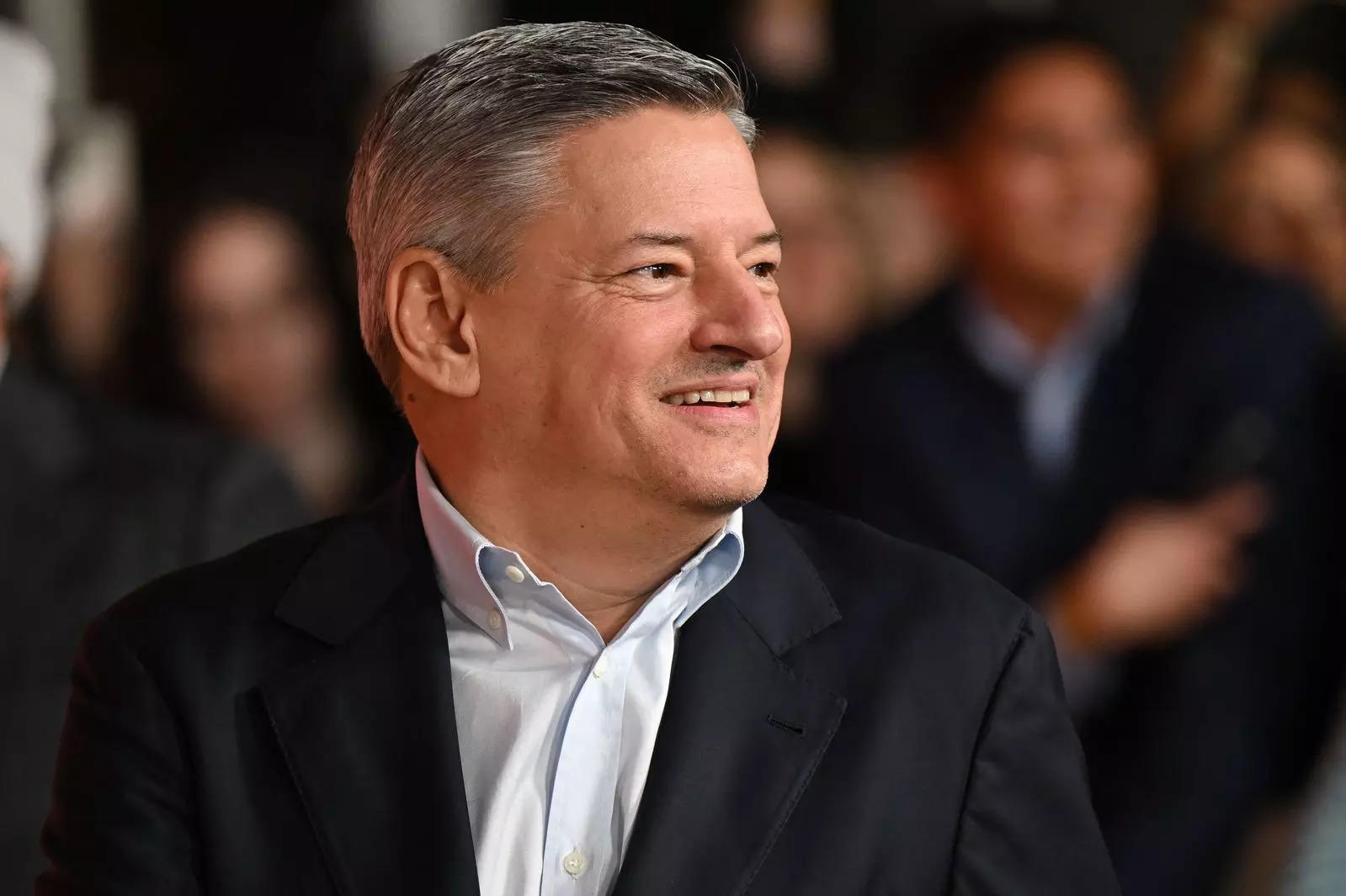

Heavily invested in India, building a local team here, says Ted Sarandos, co-CEO, Netflix: During the Economic Times Global Business Summit, Netflix co-CEO Ted Sarandos told us that the immediate priority for him is to focus on growth while creating new products after a tough first half of 2022.

Funding slowdown a chance for startups to reassess working models: Deborah Quazzo

Deborah Quazzo, the managing partner at GSV Ventures, told us that a funding slowdown can actually turn out to be healthy for Indian startups if they reassess their working models, work with profitability in mind, and not be entirely dependent on capital markets.

In Urban Mobility

Squeeze on subsidy flow chokes electric two-wheeler makers: Insiders in the electric two-wheeler industry told us sales may fall short of the 1-million-unit target this fiscal year as the government has stopped disbursing subsidies to several manufacturers that are under investigation for alleged violation of local-sourcing rules.

Uber-Tata ink deal for EV cabs: Ride-hailing company Uber has signed an agreement with Tata Motors to induct 25,000 electric vehicles (EVs) into its fleet. Uber will deploy Tata Motors’ Xpres-T EVs by partnering with Delhi NCR, Mumbai, Kolkata, Chennai, Hyderabad, Bengaluru, and Ahmedabad fleet operators.

Uber eyes third-party integrations with taxis: As part of the global initiative to increase the number of cabs on its app, ride-hailing company Uber is looking to partner with private and traditional taxi operators in India through its third-party taxi integration service.

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Tech Policy

Govt hopeful of work starting on at least one semicon unit by year-end: The Centre is hopeful that at least one of the few semiconductor projects it expects to approve by year-end will commence “ground-breaking”, a top official told us. “We kept asking the group of experts about how the proposals can be improved…. There will be announcements on the final names soon,” said the official.

Age of consent fixed at 18 in data protection law: Anyone below the age of 18 has been defined as “children” in the upcoming Digital Personal Data Protection (DPDP) Bill. The government will “review” this definition one year after the enactment of the Act, a senior official told us. The IT ministry’s decision comes amid a sustained pushback from internet and social media firms that have argued keeping the age at 18 is not in line with global standards.

Google permits alternative billing system, developers cry foul: Claiming to follow the mandate laid down by the Competition Commission of India (CCI), tech giant Google has told developers that they have time till April 26 to comply with the new Google Play payments policy which will permit alternative billing.

Digital India Bill consultation to start in March, says MoS IT: The stakeholder consultation process for the much-awaited Digital India Bill, which is likely to introduce provisions related to a comprehensive framework for the internet, will start in March, Rajeev Chandrasekhar, minister of state for electronics and information technology told us.

Tweet of the day

Data Decoded

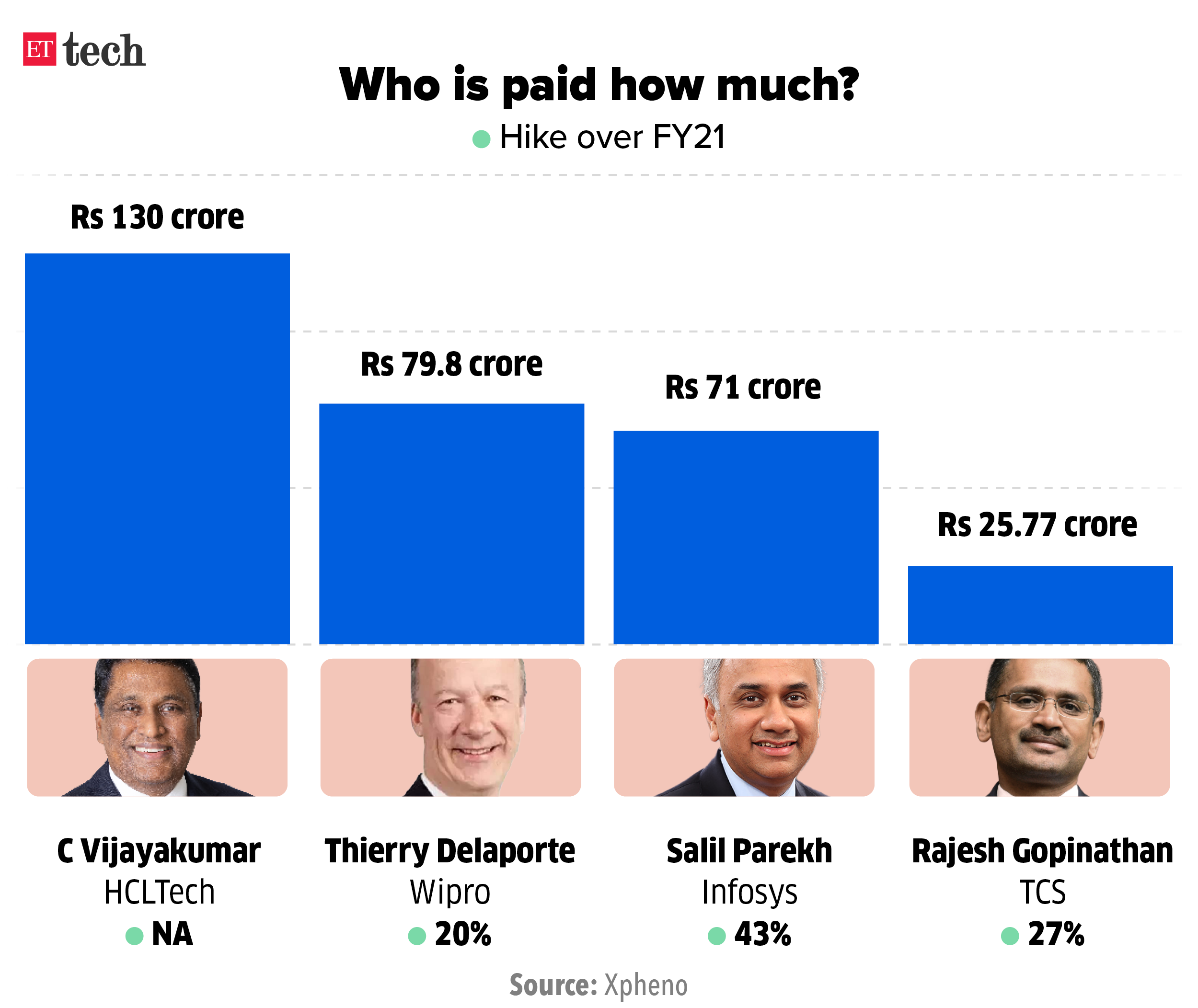

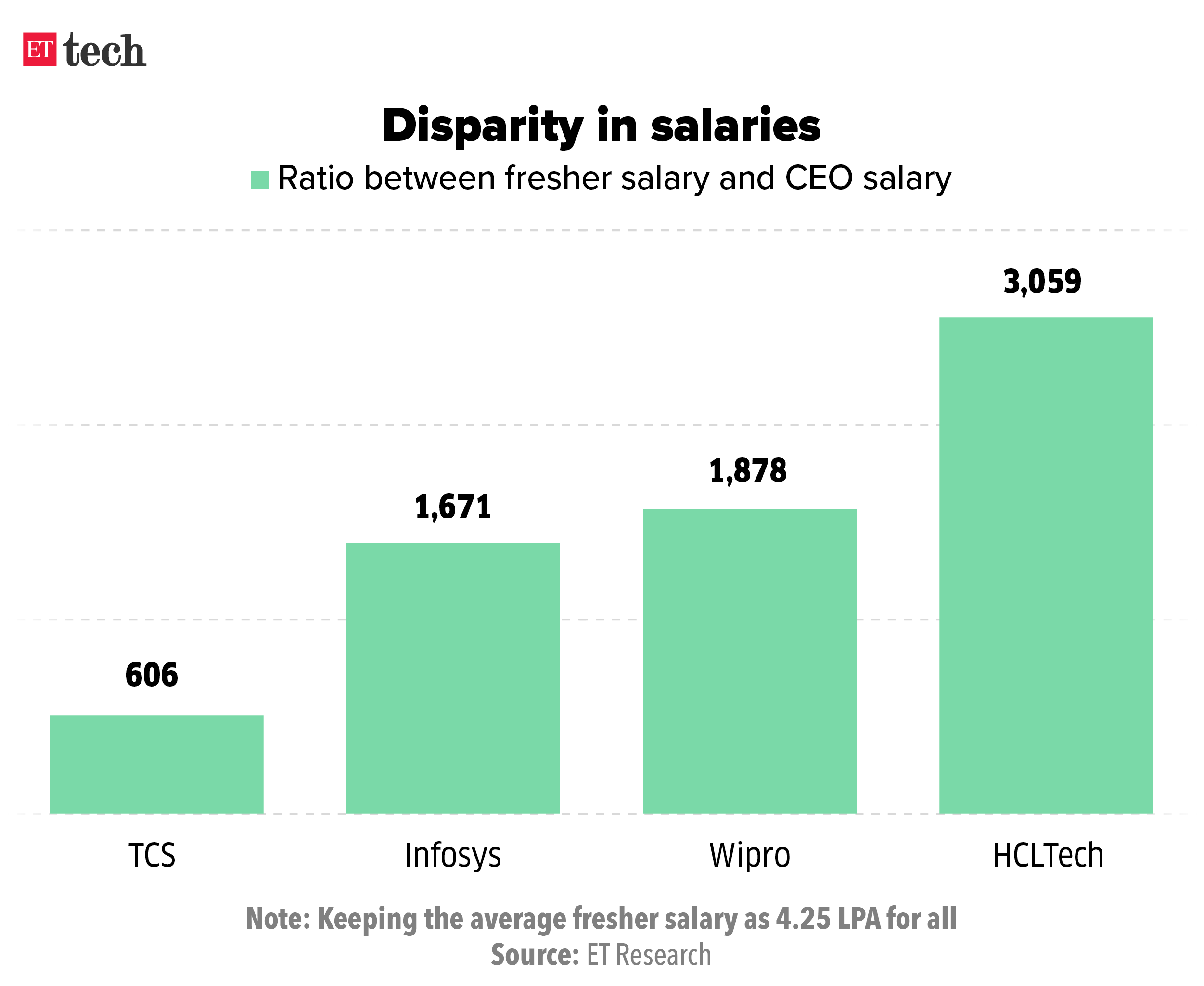

Fresher-CXO pay gap in IT firms is glaring: As the fresher salary issue has again kicked up a storm in the aftermath of Wipro telling freshers to join at a lower salary, we look at how fresher salaries compare with that of CXOs.

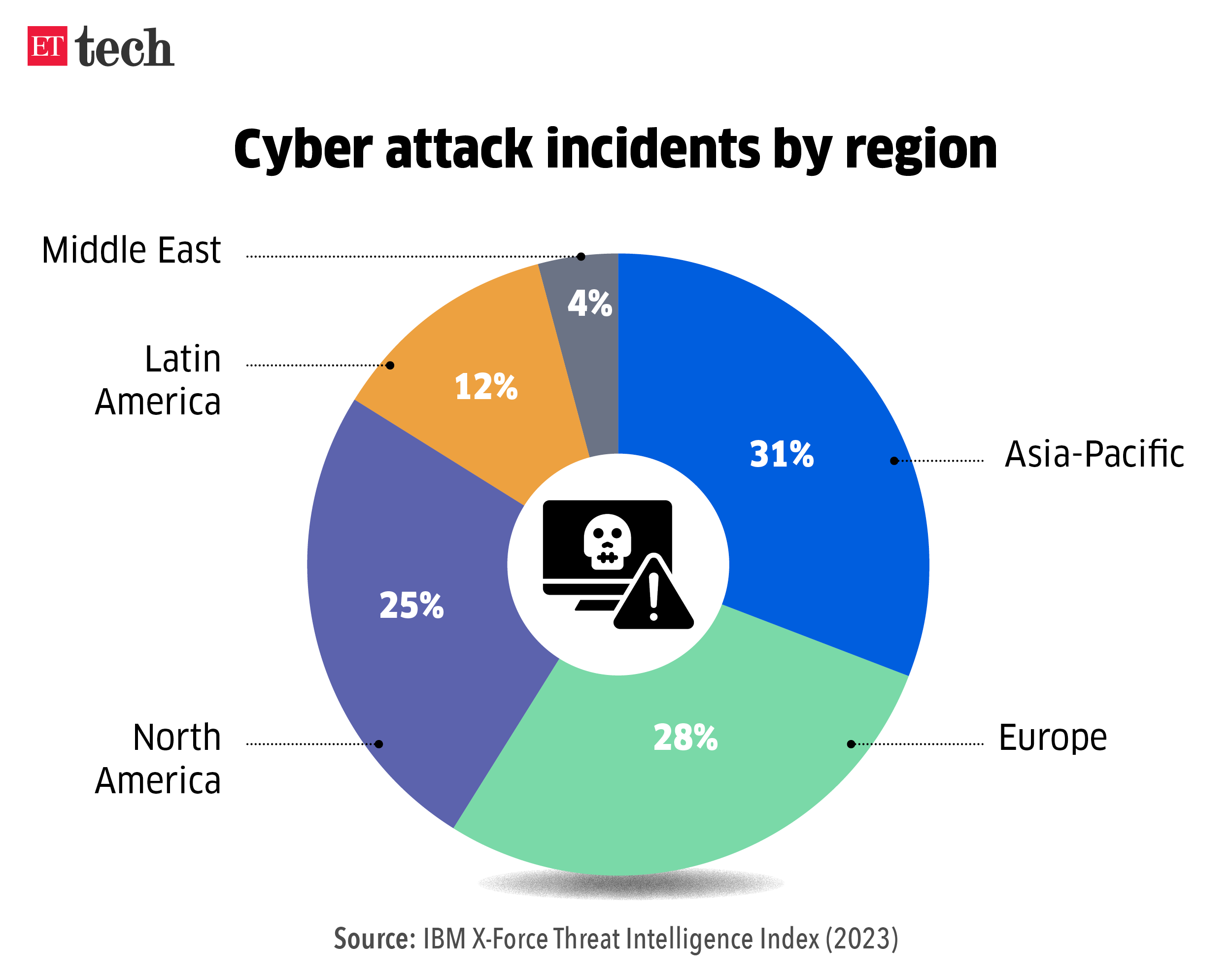

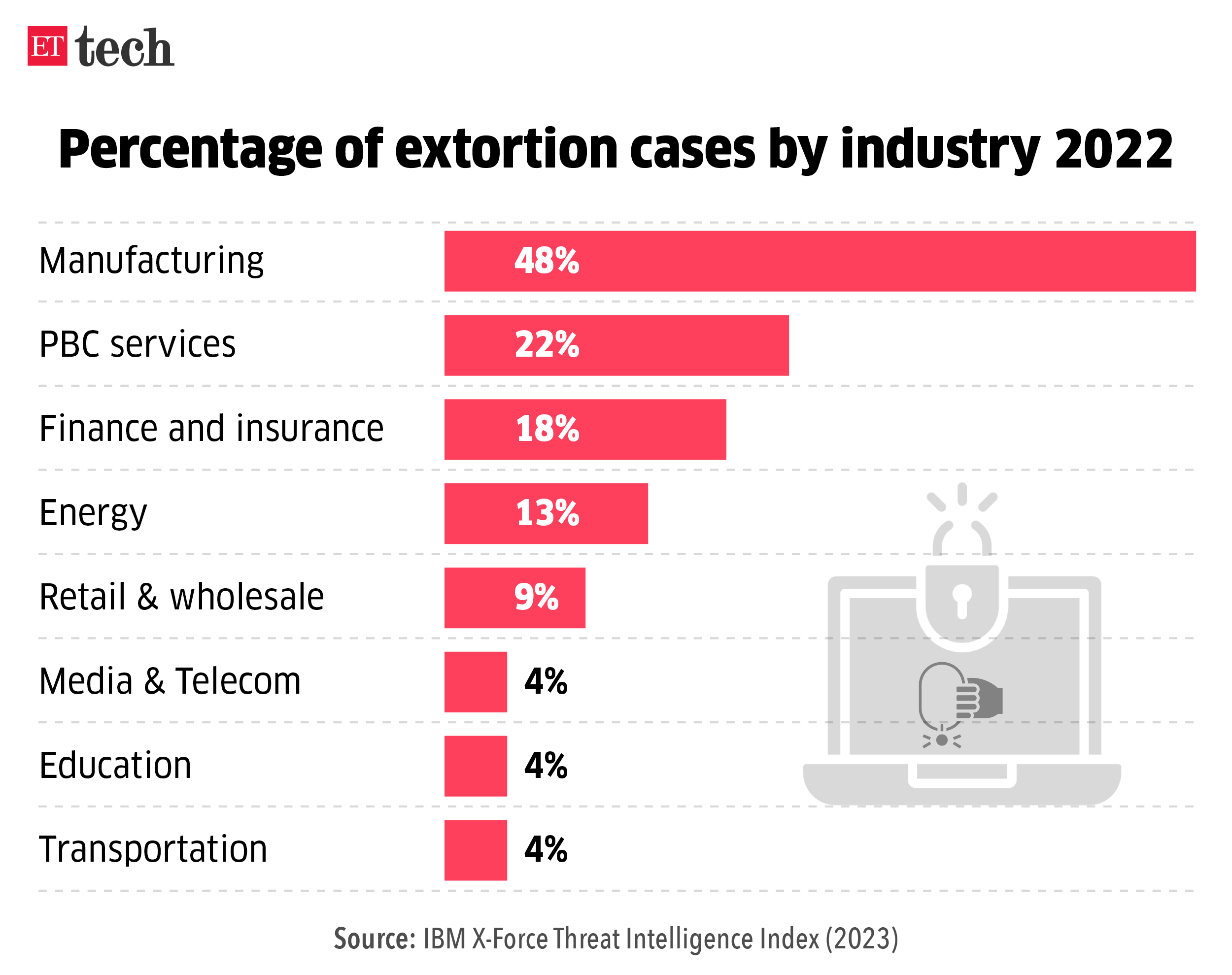

Cyber attacks on the insurance industry: The insurance industry is especially vulnerable to cyberattacks because of the sensitive information it stores, suggested a recent report by Indusface

ChatGPT Corner

Spurt in misinformation feared as ChatGPT, Bard make waves: The outsize investments into generative pre-trained bots like Microsoft-backed ChatGPT and Google’s Bard are stoking fears of a spurt in misinformation, according to industry experts. Social media intermediaries will be hard-pressed to identify “fake” content and arrest its spread on time.

When Bing meets ChatGPT: We tested the “new” Bing, which comes integrated with ChatGPT. After using it for a few days, we discovered what the AI-turbocharged search engine can do. We asked ChatGPT if it can end up replacing Google, and the answer was “no”.

Illustration and graphics by Rahul Awasthi

[ad_2]

Source link