[ad_1]

This and more in today’s ETtech Top 5.

Also in this letter:

■ Indian startup founders want IAMAI to have more Indian voices at the top

■ India blocks 14 messaging apps in J&K used by terrorists

■ Grocery app Getir in talks to take over German rival Flink: Report

Kunal Shah, founder, Cred

Kunal Shah-owned Newtap Technologies, which owns the non banking finance company (NBFC) Parfait Finance, is in talks to raise $50- $70 million, three sources in the know have told ETtech. The company may rack up a valuation of around $250 million, these people said. Cred’s existing backers like Silicon Valley’s marquee venture capital firm Sequoia Capital and Singapore’s sovereign fund GIC are expected to infuse the funds.

Cred owns around 20% stake in Newtap.

Why is this significant? If this funding round goes through, it will bolster Cred’s revenue generation capabilities since it will be able to take a bigger chunk of the personal loans being disbursed through its own books, therefore opening up better business margins.

Moreover, the fact that Cred’s existing investors are participating in this round shows their confidence in Cred’s business model and its ability to scale its credit play. Last year, GIC pumped in $80 million into Cred, while Sequoia is one of its early investors. Launched in 2018, Cred helps users pay credit card bills easily and earn rewards.

What’s next? If the equity capital comes in, Parfait Finance can step out and seek debt funding from larger NBFCs and banks. Once they can raise debt at favourable interest rates, the company can offer competitive pricing to their customers and also scale their books significantly.

Last week, ETtech reported exclusively that neobanking startup Jupiter has secured an NBFC licence from the country’s central bank, a development that will help it dole out credit from its books. Jitendra Gupta, founder of Bengaluru-based Amica Financial Technologies Ltd., which runs the startup, told ETtech that the Sequoia and Tiger Global backed-Jupiter intends to capitalise the lending business with around Rs 100 crore and raise an additional Rs 100 crore in debt to fund the NBFC’s credit operations. It aims to hit annual disbursements of Rs 600-700 crore in short- and medium-term personal loans.

Rohan Verma, CEO and executive director of MapmyIndia, on Monday said that IAMAI was “parroting & promoting views that are anti-Indian and pro-foreign big tech”.

IAMAI is an association representing certain tech companies. Its members include multinational giants Google, Meta and Microsoft, as well as Indian tech firms such as Paytm, Ola, PhonePe, Unacademy and Byju’s.

Quote unquote: “I hope everyone realises that the Chair & Vice Chair of IAMAI are from the Foreign Big Tech. Sad to see an org originally founded by and for Indian companies, taken over & now promoting a false narrative. IAMAI views & submissions to govt & media on digital policies, regulations, laws etc are completely wrong and antithetical to what Indians — consumers, industry, government — need,” he tweeted.

Anupam Mittal, founder of Shaadi.com parent People Group, also tweeted on the issue saying: “It (IAMAI) appears to have become a mouthpiece of big tech”.

Who heads IAMAI? Verma pointed out that IAMAI’s executive council was currently led by Sanjay Gupta, country head & vice president, Google, as chairman, with Shivnath Thukral, public policy director, India, WhatsApp Inc, serving as vice-chairman. He added that IAMAI should either change to “truly reflect the voice and aspirations of India” or the body should be given no “credence”.

ETtech reported last week that Indian startups planned to oppose the draft comments, saying they favour big tech platforms over Indian internet companies.

What’s the issue? In its draft note on digital competition, the IAMAI has flagged recommendations by the Parliamentary Standing Committee on Finance on designating systemically important digital intermediaries (SIDIs), or a small number of players that can negatively influence competitive conduct in the digital ecosystem.

India blocks 14 messaging apps in Jammu and Kashmir used by terrorists

After getting inputs from intelligence agencies, the central government has blocked 14 messenger mobile applications that were largely used in Jammu and Kashmir by terrorists, per news reports.

Which apps were blocked? News agency ANI quoting sources said the blocked apps include Crypviser, Enigma, Safeswiss, Wickrme, Mediafire, Briar, BChat, Nandbox, Conion, IMO, Element, Second line, Zangi and Threema.

According to sources, these mobile applications were used by terrorists in Kashmir to communicate with their supporters and on-ground workers (OGW).

Details: The apps have been blocked under Section 69A of the Information Technology Act, 2000, an official said.

Quote, unquote: “Agencies keep track of channels used by Overground workers (OGWs) and terrorists to communicate among themselves. While tracking down one of the communications, agencies found that the mobile application does not have representatives in India and it is difficult to track down activities happening on the app,” the news agency quoted the official as saying.

Tweet of the day

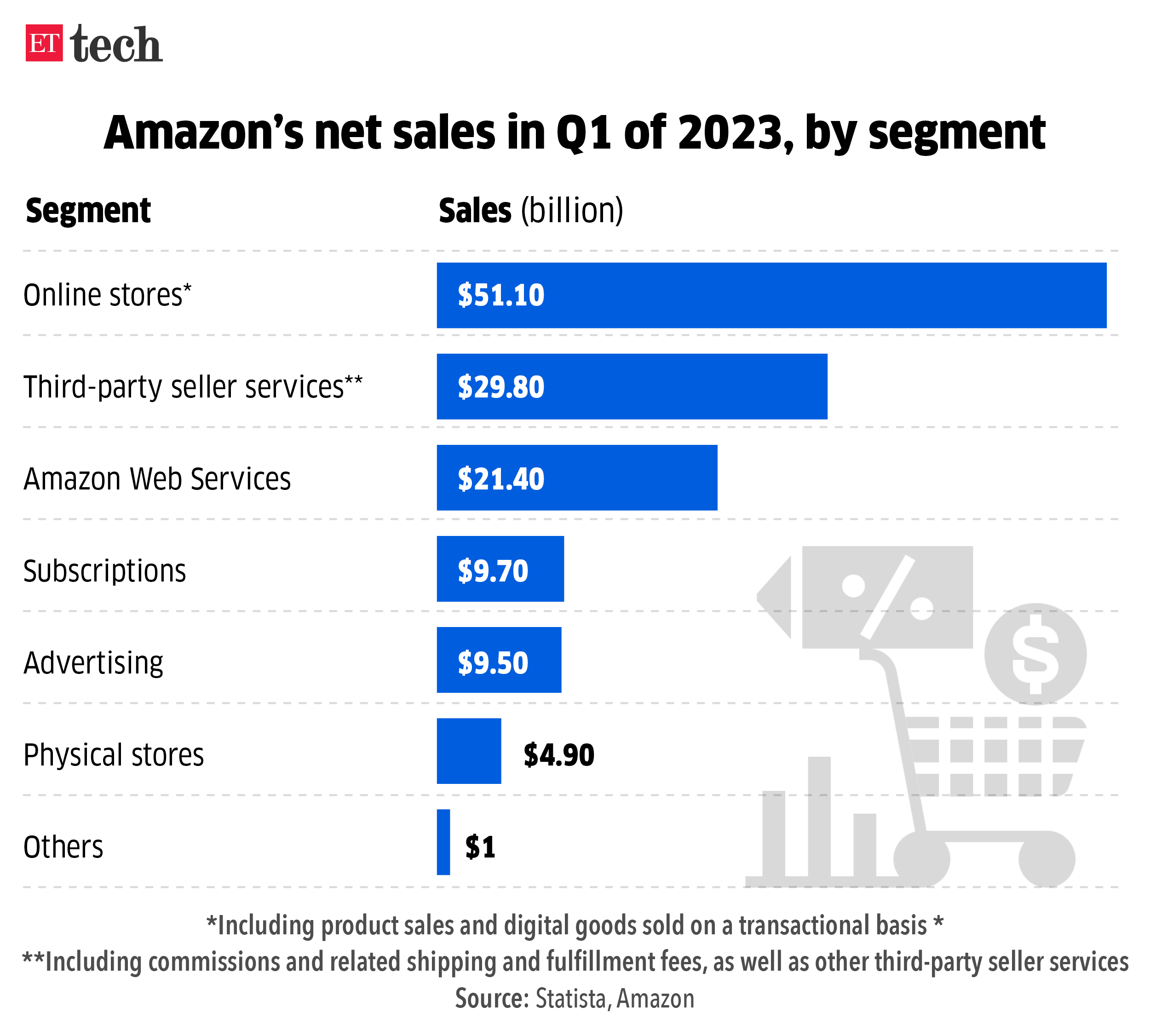

Infographic insight : Why Amazon is not just an eStore

Ecommerce giant Amazon reported better-than-expected revenue in the January-March quarter, but also raised concerns over slowing growth in the cloud business as its customers trimmed spending.

Revenue for the quarter stood at $127.4 billion and the ecommerce giant reported a $3.2 billion net profit against a $3.8 billion loss in the same period last year.

However, concerns emerged over Amazon Web Service (AWS), the company’s cloud business, as sales rose 16% from the year before to $21.4 billion, which is slower than the 37% growth that Amazon reported a year ago.

“As expected, customers continue to evaluate ways to optimise their cloud spending in response to these tough economic conditions in the first quarter,” CFO Brian Osavsky had told analysts, warning that April figures pointed towards AWS revenue growth rates about 500 basis points below Q1 growth.

AWS is Amazon’s third-biggest operating segment in terms of sales, but because it is by far the most profitable part of the company’s vast operations, investors tend to look at its performance particularly closely.

The chart illustrates how the online retailer has expanded its business considerably over the past few years.

While its core “online stores” accounted for 64% of sales in Q1 2017, they contributed just 40% of total sales in the latest quarter.

Grocery app Getir in talks to take over German rival Flink: report

Istanbul-based online grocery startup Getir is in talks to take over German rival Flink in a key step toward consolidation in Europe’s food-delivery market, where companies are battling a slowdown after Covid-19, the Financial Times said on Monday.

Discussions between the two European groups are continuing and there is no guarantee of an agreement being reached, the report said.

Details: After their rapid expansion, quick commerce businesses were hit in March last year by a fall in lockdown-driven demand for deliveries and rising interest rates, while investors soured on loss-making tech firms. After more than a dozen rapid grocery apps, which promised to deliver groceries and convenience-store items in as little as 10 minutes, launched in the US and Europe by mid-2021, only a handful of players now remain.

Flink eyes funding: Flink is also in talks to raise funding of about $100 million from existing investors, for a valuation of more than $1 billion, according to the news report.

Past purchase: In a $1.2-billion deal last December, Getir bought German grocery company Gorillas, merging two of Europe’s remaining companies offering groceries in minutes.

Today’s ETtech Top 5 newsletter was curated by Erick Massey in New Delhi and Megha Mishra in Mumbai. Graphics and illustrations by Rahul Awasthi.

[ad_2]

Source link