[ad_1]

This week, news website Semafor reported that the software giant is in talks to invest $10 billion in OpenAI, the company behind the revolutionary new chatbot ChatGPT, in a deal worthy of Shank Tank’s hall of fame.

The funding round would value OpenAI at $29 billion, and Microsoft would get a staggering 75% of the company’s profits until it recouped its initial investment.

After that, it would have a 49% stake in OpenAI, with other investors sharing another 49% between them and OpenAI’s non-profit parent firm getting 2%, Semafor said.

That’s badass.

Microsoft first bet on OpenAI in 2019 with a $1 billion investment, and followed this up with another $2 billion over the next few years.

The software giant didn’t just back OpenAI with a boatload of money – its cloud services arm Azure provided the massive computing power needed to power ChatGPT. This led to a series of rapid breakthroughs that culminated in the internet losing its collective mind last month.

But Microsoft hasn’t always been this slick and successful in its efforts to push the boundaries of AI — and that’s putting it mildly.

In March 2016 – a simpler, more innocent time – the company decided it would be a good idea to improve the conversational abilities of its cutting-edge new chatbot ‘Tay’ by letting it loose on Twitter, of all places.

Developed by Microsoft to conduct research on “conversational understanding”, Tay was designed to talk like a 19-year-old American girl and marketed as ‘The AI with zero chill’.

The more humans chat with Tay, the smarter it gets, Microsoft said, betraying a rather naive understanding of human behaviour on the internet. Like we said, it was a more innocent time.

Not long after “she” made her debut with tweets such as, “Can I just say that I’m stoked to meet u? Humans are super cool”, pranksters, trolls and layabouts began to bombard Tay’s developing AI mind with a strict diet of human depravity.

In less than 24 hours, Tay transformed from a bubbly teenager into a racist, misogynistic, Holocaust-denying Nazi.

As internet weirdos had a field day, Microsoft quickly realised that giving Tay a “repeat after me” function wasn’t its best idea ever, and promptly pulled the plug.

But plenty of damage had already been done. In her brief 16-hour “life”, Tay put out more than 96,000 tweets, gifting her creator a steaming pile of internet garbage and a PR disaster for the ages.

Written by Zaheer Merchant

Tech policy

Govt seeks views on rules for live commerce platforms: The Bureau of Indian Standards (BIS), under the Ministry of Consumer Affairs, has initiated talks with stakeholders on a regulatory framework for live commerce in the country. The Indian standards body, an email reviewed by ET showed, has sought comments from members of its retail, e-commerce and e-payment services sectional committee after the ISO floated a ballot to register a new proposal on live commerce.

Meanwhile, the Central Consumer Protection Authority (CCPA) on Thursday issued notices to Amazon, Flipkart and Snapdeal for alleged sale of toys without BIS quality mark. It announced that it had seized 18,600 toys in the last one month from major retail stores, including Hamleys and Archies, over for lack of BIS mark.

ETtech Explainer | How CCI’s Android ruling could affect Google: In October 2022, the Competition Commission of India (CCI) ordered search giant Google to make fundamental changes to how its Android mobile operating system is licensed. With the January 19 deadline to make these changes approaching, Google has argued that the directives could stall growth of the Android ecosystem in India, where 95-97% of smartphones run on its mobile operating system. Read this explainer to understand the case in detail

Industry bodies seek staggered implementation of data protection law: The government must follow a phased implementation once the recently drafted Digital Personal Data Protection Bill, 2022, becomes law, industry bodies have said. IT industry body Nasscom has suggested that since the earlier versions of the draft had a timeframe of 24 months for implementation, the new iteration should consider the same. Industry body BSA, The Software Alliance said the Bill should provide a clear transitional period of at least two years for implementation.

Govt may seek deals with other countries for India-made chips: The Indian government plans to ask countries that currently procure semiconductor chips from nations such as China and Taiwan to buy made-in-India chips instead, sources aware of the development told us. At least five consortia are awaiting clearance to set up semiconductor fabs in the country.

Regulatory Review

RBI directs PayU India to reapply for payment aggregator licence: The Reserve Bank of India (RBI) asked online payments gateway PayU India to reapply for its payment aggregator (PA) licence. As a result, PayU India has stopped onboarding new merchants on its platform. RBI’s decision comes less than two months after the regulator returned the PA licence application of Paytm and asked it to reapply.

Sebi sends notices to PE, VC funds for flouting rules: The Securities and Exchange Board of India (Sebi) has sent notices to several Alternative Investment Funds (AIFs), which include both private equity investors and venture capitalists, for alleged violation of specified tenure rules on their investment vehicles.

Funding and M&As

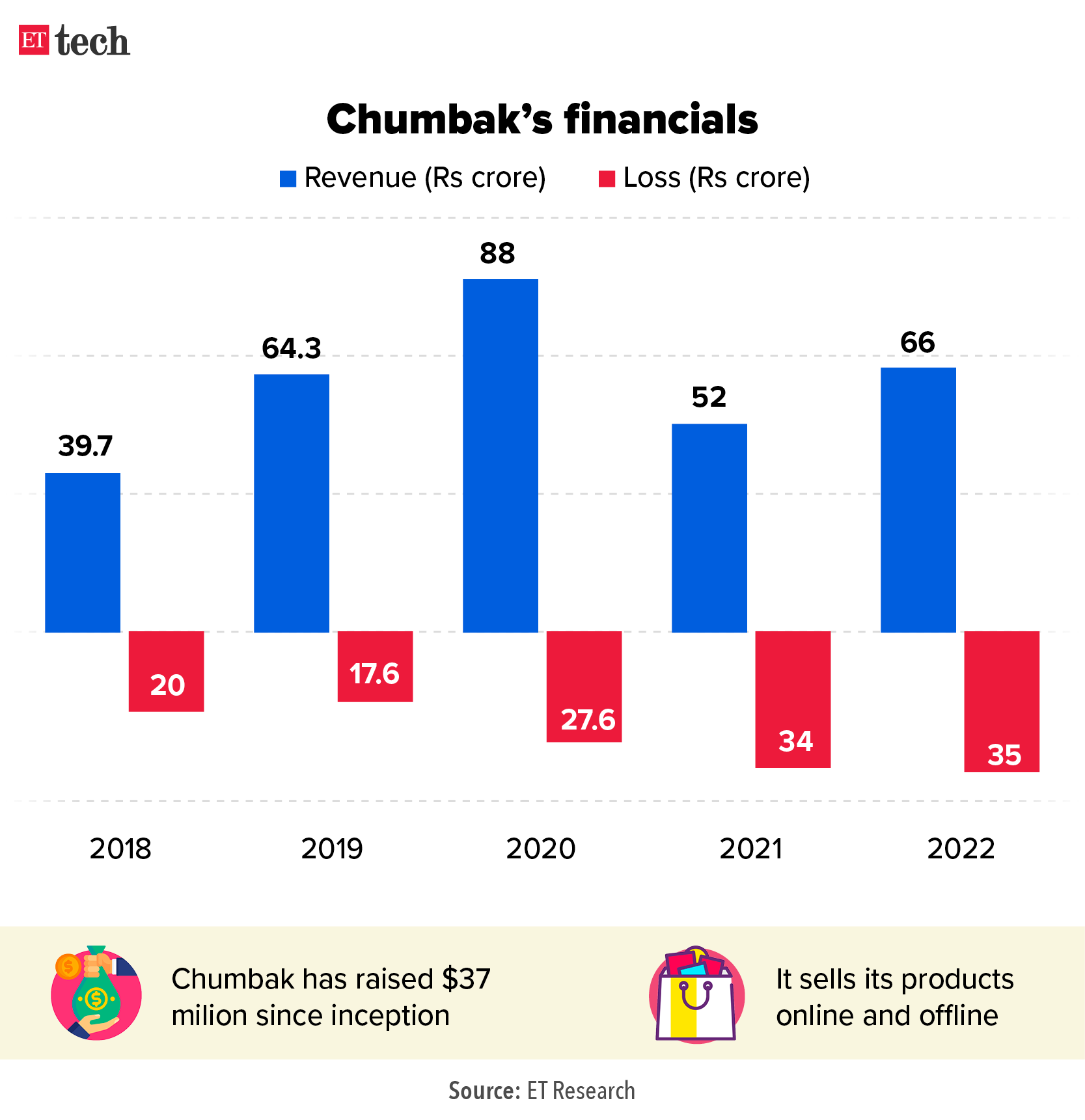

Goat Brand Labs acquires Chumbak, four other brands: Goat Brand Labs has acquired Chumbak and four other direct-to-consumer ( D2C) brands, taking its portfolio to 20, the ecommerce brand rollup firm said on Thursday. Goat, backed by Flipkart Ventures and Tiger Global, did not name the other four brands.

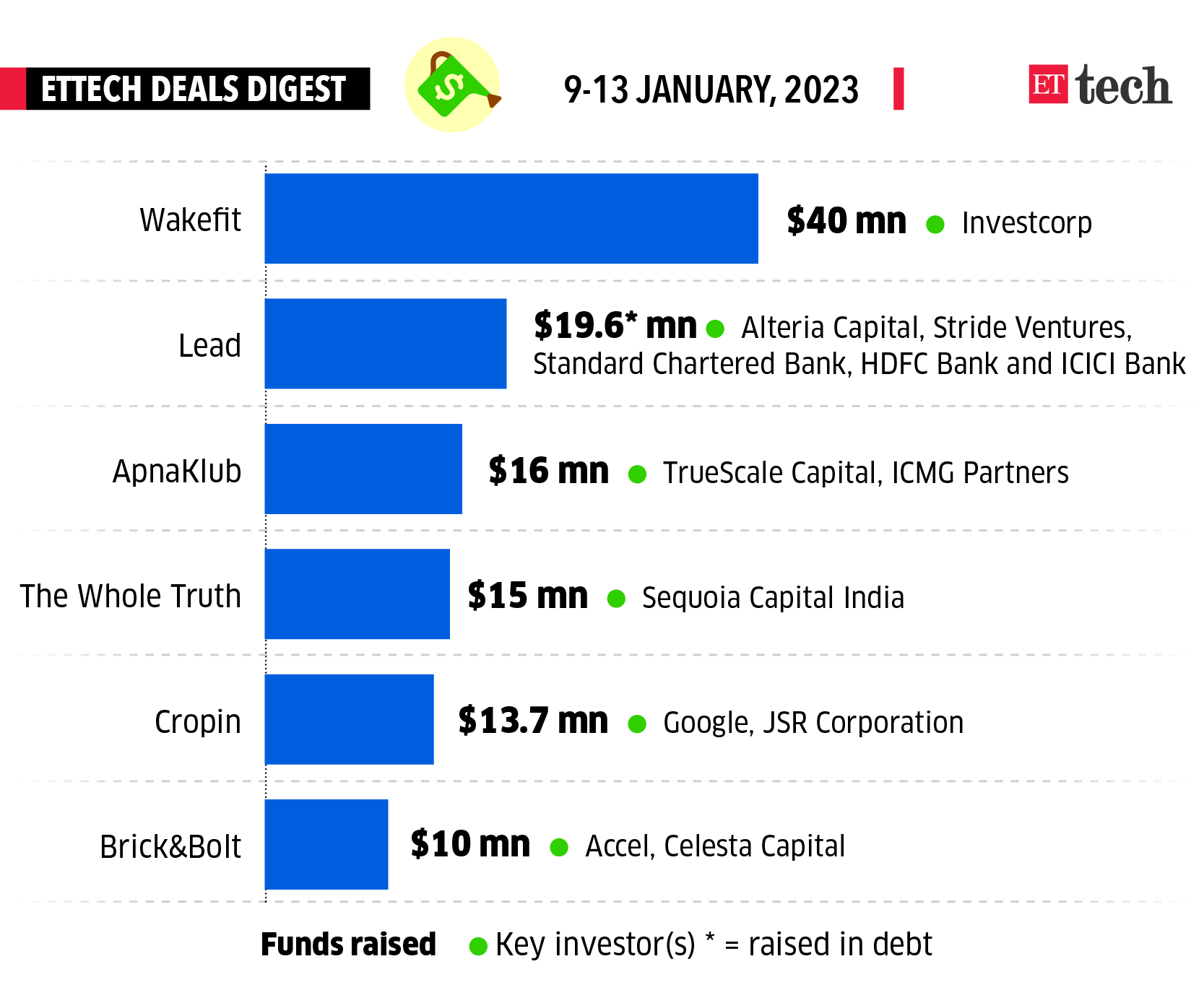

Wakefit, a direct-to-consumer (D2C) mattress and furniture maker, has raised $40 million led by Investcorp. The company will use the funds to improve its delivery operations and factory, and to make inroads into tier II and tier III cities, cofounders Ankit Garg and Chaitanya Ramalingegowda told ET.

Health food brand The Whole Truth has raised $15 million in its Series B round, led by Sequoia Capital India. The Mumbai-based company has been valued at around Rs 600 crore, or about $73 million, following the funding, founder and CEO Shashank Mehta told ET.

Edtech firm Lead raised Rs 160 crore in funding via a mix of long-term capital from Alteria Capital and Stride Ventures, and working capital financing from banks, including Standard Chartered Bank, HDFC Bank and ICICI Bank. The edtech unicorn plans to use the fresh capital to finance organic and inorganic growth ambitions.

Online construction marketplace Brick&Bolt raised $10 million from global venture capital firms Accel and Celesta Capital. The startup said it plans to use the fund to expand to 12 cities in the next 15 months.

ETtech Deals Digest: funding winter continues to chill startups

Layoffs

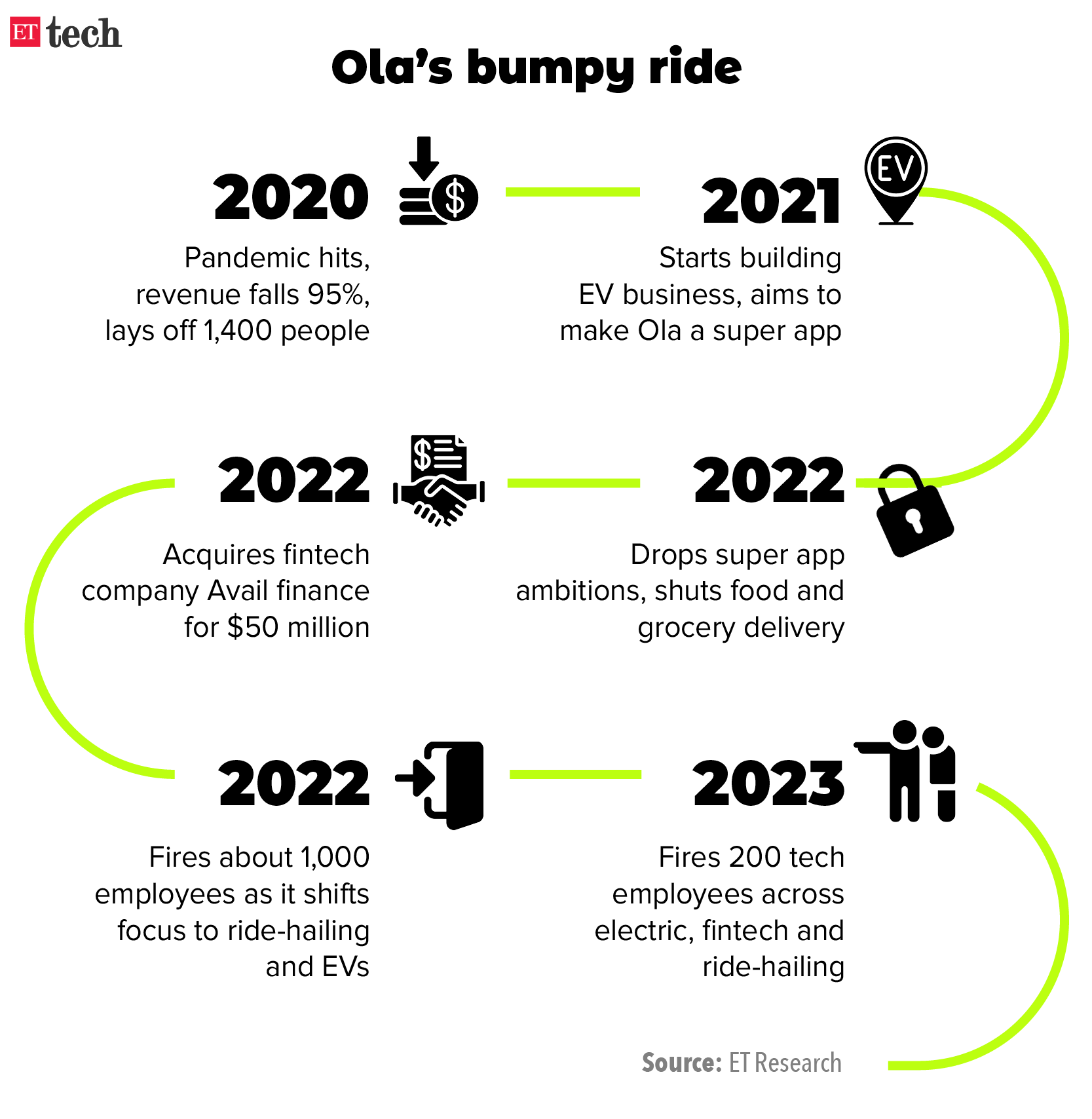

Ola fires about 200 employees: Ride-hailing and electric vehicle company Ola has laid off about 130-200 employees in a fresh round of layoffs at the SoftBank-backed mobility firm. The layoffs have happened across the ride-hailing, electric vehicle and fintech businesses, one of the sources said. In September, the company rescinded the retrenchment of about 200 engineers.

Cashfree lays off over 100 employees: Online payments service provider Cashfree laid off around 100 employees as it looked to reduce costs and cash burn. The Bengaluru-based fintech startup, backed by YCombinator and Apis Partners, sacked employees across sales and merchant onboarding earlier this week. Cashfree is the latest large internet firm to cut jobs in a tough funding environment, joining several Indian startups — especially edtech firms — and big tech firms such as Meta and Amazon, which have announced layoffs in the last few months.

Pune labour commissioner summons Amazon over mass layoffs: Amazon India executives have received summons to appear before a regional labour office on January 17, following its plan for extended layoffs globally, which also includes cutting around 1,000 roles in India. The notice was sent to Amazon by the assistant labour commissioner’s office in Pune on a complaint by a city-based IT sector employees union, Nascent Information Technology Employees Senate (NITES).

Results Corner

Infosys Q3 results: net profit up 13.4% YoY to Rs 6,586 crore: Infosys on Thursday reported a 20.2% year-on-year (YoY) rise in consolidated revenue for the quarter ended December 2022 to Rs 38,318 crore. Consolidated net profit for the quarter rose 13.4% on year to Rs 6,586 crore. The software major raised its constant currency (CC) revenue growth guidance for the current financial year to 16-16.5% from 15-16% earlier.

TCS Q3 net surges 11% to Rs 10,846 crore: Tata Consultancy Services (TCS) reported 11% on-year growth in net profit for the third quarter of the financial year. The company also saw a reduction in its total workforce for the first time in ten quarters as it slowed down fresh hiring. The company said revenue came in at ₹58,229 crore, up 19.1% year on year, led by demand for cloud solutions, surpassing analyst estimates. The company declared an interim dividend of ₹8 and a special dividend of ₹67 per equity share.

TCS rolls out 100% variable pay: Tata Consultancy Services (TCS) has rolled out 100% variable pay for 70% of the employee base for the third quarter ended on December 31. The Tata Group company awarded 100% variable pay for the second quarter of FY23 as well.

HCL Tech net profit up 19%: HCL Technologies’ net profit rose 19% in the third quarter, beating Street estimates, but the IT services provider cut the top end of its annual revenue and operating margin guidance amid a challenging demand environment. HCL Tech now expects annual revenue growth to be in the 13.5-14% range on year, compared to 13.5-14.5% forecast earlier.

Zerodha profits shoot up 87%: Stock brokerage firm Zerodha’s net profit increased 87% in fiscal year 2022 (FY22) to Rs 2,094.3 crore from Rs 1,122.3 crore in FY21, while operating revenue jumped to Rs 4,963.7 crore from Rs 2,728.9 crore in the same period, according to its audited financial statement filed with the Ministry of Corporate Affairs (MCA).

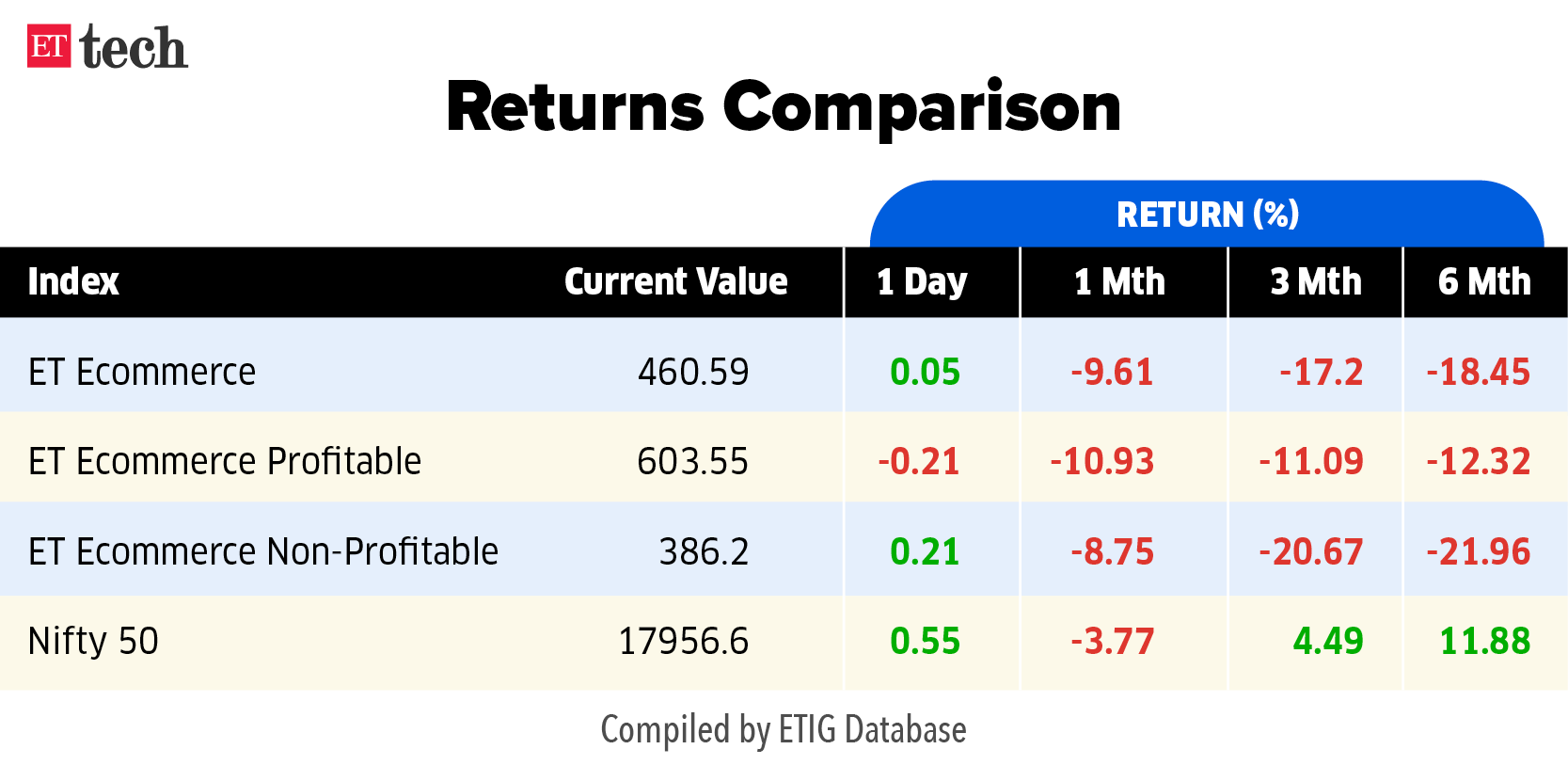

ET Ecommerce Index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Top-level Appointments

Cognizant appoints Ravi Kumar as CEO: Cognizant on Thursday, named Ravi Kumar S as CEO and member of its Board. Kumar succeeds Brian Humphries in both roles, who will remain with the company in a special advisor role till March 15, 2023. Cognizant announced last year that Kumar will join Cognizant after a 20-year career at Infosys, where he held various leadership roles, most recently serving as President from January 2016 through October 2022.

Paytm Payments Bank appoints Surinder Chawla as MD & CEO: Paytm Payments Bank has appointed Surinder Chawla as managing director and CEO. He replaced Deependra Singh Rathore, who was made interim CEO after Satish Kumar Gupta retired in October 2022. Chawla joined from RBL Bank, where – as head of branch banking – he had focused on expanding its current account, savings account (CASA) base, fee revenue and cross-selling across channels.

Meta names Vikas Purohit as head of global business in India: Meta on Monday named Vikas Purohit as its director of its global business group in India to lead the strategy of working with advertisers and agency partners. Purohit will spearhead the company’s relationship with the country’s leading brands and advertising agencies to drive Meta’s revenue growth across key channels in India and accelerate the adoption of digital tools by the largest advertisers and agencies, the company said in a prepared statement.

Also read | Adda247 elevates CPO to cofounder

In Other News

Ola to shut Avail Finance app: Ola Financial Services has ceased lending to customers, largely blue-collar workers, through the app of a recently acquired entity Avail Finance. The development comes amid increased regulatory scrutiny on online digital lending practices by the Reserve Bank of India. Ride-hailing firm Ola acquired Avail Finance, founded by Ola founder Bhavish Aggarwal’s brother Ankush Aggarwal, for about $50 million in April last year.

Flipkart marketplace arm gets $90 million cash infusion: Flipkart Internet has received a cash infusion of about $90 million (Rs 722 crore) from its Singapore-based parent entity, according to regulatory filings accessed through business intelligence platform Tofler. A resolution to infuse the capital – the first this year – was approved on December 29. In March 2022, Flipkart Marketplace received over $553 million from Walmart.

Byju’s asks creditors for more time to recast $1.2-billion debt: Byju’s has sought more time from its creditors to renegotiate an agreement pertaining to a $1.2-billion loan that is in breach of covenants, news agency Bloomberg reported, citing sources familiar with the matter. According to the report, the creditors had until Tuesday to sign a forbearance agreement, which will give the company time till February 10 to negotiate broader terms for the loan.

Illustrations and graphics by Rahul Awasthi

[ad_2]

Source link