[ad_1]

Also in the letter:

■ Slowdown hits used car startups

■ A bunch of startups buck trend to offer double-digit hikes

■ US fund slashes Eruditus’ valuation by 8.6% to $2.9 billion

Exclusive: Apple says it need concrete reason to take down banned betting apps

Amid a government crackdown on betting apps in India, iPhone maker Apple has told Indian officials that it needs a “concrete reason or a legal requirement” to fully comply with the Centre’s directive and disable the apps from its App Store.

Driving the news: Without outrightly refusing to comply with the February order by the ministry of electronics and information technology (MeitY), the company has made it clear that it cannot “arbitrarily” remove the apps and make them unavailable in India, sources told us. The iPhone-maker is “vetting” the apps to ensure “only the wrong or bad players of the ecosystem” are taken down.

Quick recap: ET had reported last week that several betting apps including Betway and Lotus 365, banned by the Centre earlier this year, continue to advertise their operations on digital platforms in defiance of the rules. Many of them continue to be available on the Apple App store.

Tell me more: As an interim measure, Apple has taken down some of the banned apps, while finding the “best possible solution” for the others. “When the government issues takedown orders, Apple has one of three options — to tell MeitY that they cannot take down the apps and provide a reason for the same, take the government to court like Twitter did or to comply,” a source told ET.

Background: These apps were allegedly in violation of Section 69 of the IT Act and were believed to contain material that was a threat to the sovereignty and integrity of the country when they were banned. Legal experts say that this clause and its wording have provided Apple the opportunity to challenge the locus standi of the government.

Exclusive: Silicon Valley’s Tribe Capital plans to raise $250 million India-dedicated fund

Arjun Sethi, cofounder and partner at Tribe Capital

Hi, this is Samidha Sharma in Mumbai. Tribe Capital, founded by former executives of Chamath Palihapitiya’s venture capital firm Social Capital, plans to launch an India-dedicated fund with a corpus of $250 million. That’s a brave call, coming at a time when most VCs are finding it hard to deploy the capital they raised over the last two years.

I spoke to Arjun Sethi, cofounder and partner at Tribe Capital about the fund, India opportunity, and the overall tech ecosystem. Having known Sethi for years (since his Social Capital days), he has never sounded as aggressive about India as he does now. Remember, it’s been tough going for Tribe which backed a number of cryptocurrency ventures included the now bankrupt FTX.

Driving the news: Sethi told me that Tribe is in the midst of setting up an Alternate Investment Fund (AIF) which will be domiciled in India and operated by a local team based out of New Delhi. Tribe India Venture AIF, Fund I, has already started conversations with limited partners or sponsors who pool in capital and expects to close the discussions in a few months. We expect to focus on AI, software, and fintech, he added. Tribe’s big India bets include logistics aggregator Shiprocket, BlackBuck, a trucking platform, Khatabook, which helps small businesses keep digital records, among others.

Why an India fund? Looking at the maturity of capital providers and entrepreneurs with tech experience, we believe that the Indian ecosystem is roughly a decade behind the US, Sethi said.

He added that both the Indian venture market and the economy are growing much quicker than in the US, which have acted as factors for entrepreneurs. We believe that the Indian opportunity is not only driven by its domestic market growth, but by its value capture through impending Indian exports globally, he added.

Buying secondaries: “We are active in India and have been leaning in during the current environment by acquiring more ownership in our current portfolio by transacting secondaries at discounts. As venture investors we take a long-term view and only invest in companies where we have underwritten a 5-10x outcome, so small changes (10-20%) in valuation generally do not materially affect our appetite. However, when we see very large discounts like 50% or higher, we will be more aggressive, such as our secondaries strategy I mentioned above,” Sethi said.

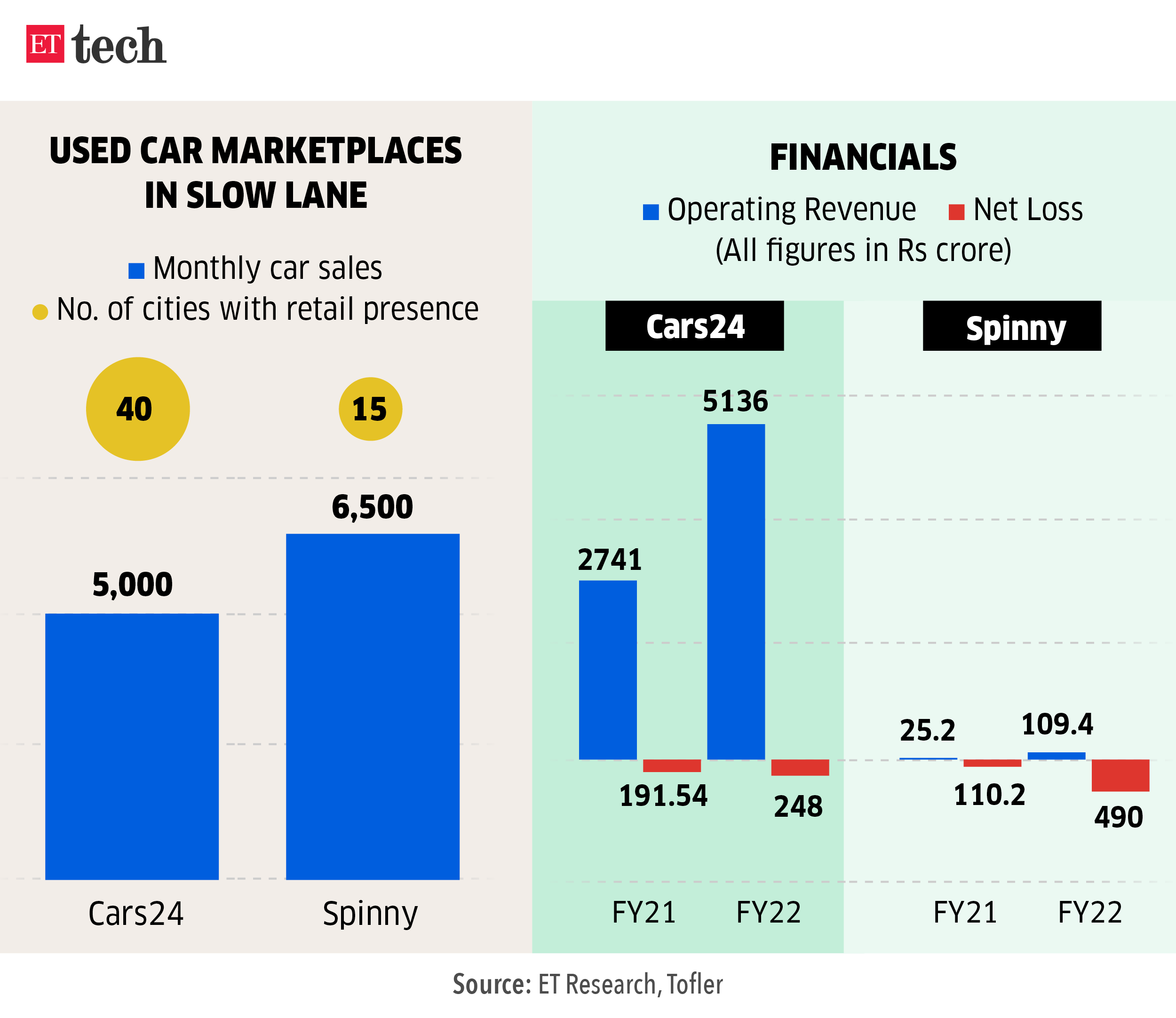

Used car startups take a U-turn as sales remain sluggish

Hi, this is Pranav Mukul in New Delhi. Used car startups are dialing down after the boom of 2021 and 2022 driven by supply chain constraints post-pandemic and the Russia-Ukraine war, with some postponing expansion plans and others exiting market completely.

Driving the news: ETtech has learned that SoftBank-backed Cars24 is executing a calculated expansion of cities from where it was buying cars, even as it has paused growing the number of cities where it sells cars from.

Why the slump? Experts say the demand for cars isn’t slowing down, as new car sales are touching record highs, which ensures a fresh supply of older cars. However, it also takes away from the growth seen when customers with an appetite for four-wheelers had to turn to used cars due to long waiting periods for new vehicles. As these platforms aim to become more prudent in buying and selling used vehicles, a key concern is the vintage inventory purchased during the peak growth period in 2021 and early 2022.

Quote, unquote: “To show profitable growth, companies are now buying and selling cars at a more market determined rate compared to a year ago. But a key question that investors are raising is about the inventory they bought at prices higher than market rates when they were sitting on a long cash runway,” an investor backing one of the used car platforms said.

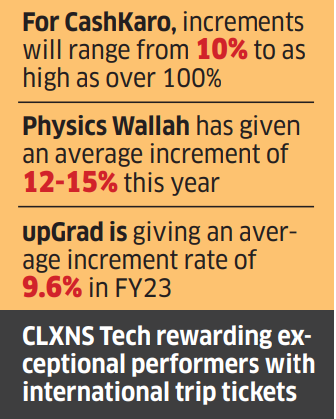

A bunch of startups buck trend to offer double-digit hikes

Employees at startups such as upGrad, Revfin and Hero Vired will likely receive double-digit pay hikes this year, executives at several of these firms told ET, signalling their ability to negotiate a protracted funding winter that has caused both jobs and wages to shrink.

Who’s offering what: CashKaro, Clevertap, Physics Wallah, CLXNS Technologies and DaveAI are among those offering their staff satisfactory pay increases that are sometimes even better than those given last year.

Also read | Startup jobs shrink to a third; hikes fall amid funding freeze

Tell me more: “Increments will range from 10% to as high as over 100% depending on team, revenue contribution and future potential,” said Swati Bhargava, co-founder of CashKaro. This year, Physics Wallah has handed out an average increment of 12-15%, said its HR head Satish Khengre. UpGrad has doled out an average increment of 9.6%. Another trend is the shortening of appraisal cycles – from annual to half-yearly or even quarterly/monthly in some cases.

Quote, unquote: In addition to the existing mid-year performance assessment, we are initiating monthly assessments for a few roles,” said Monika Saxena, chief strategy officer at Revfin, an EV finance company. CLXNS Technologies also plans to shorten the annual appraisal cycle to a six-monthly exercise.

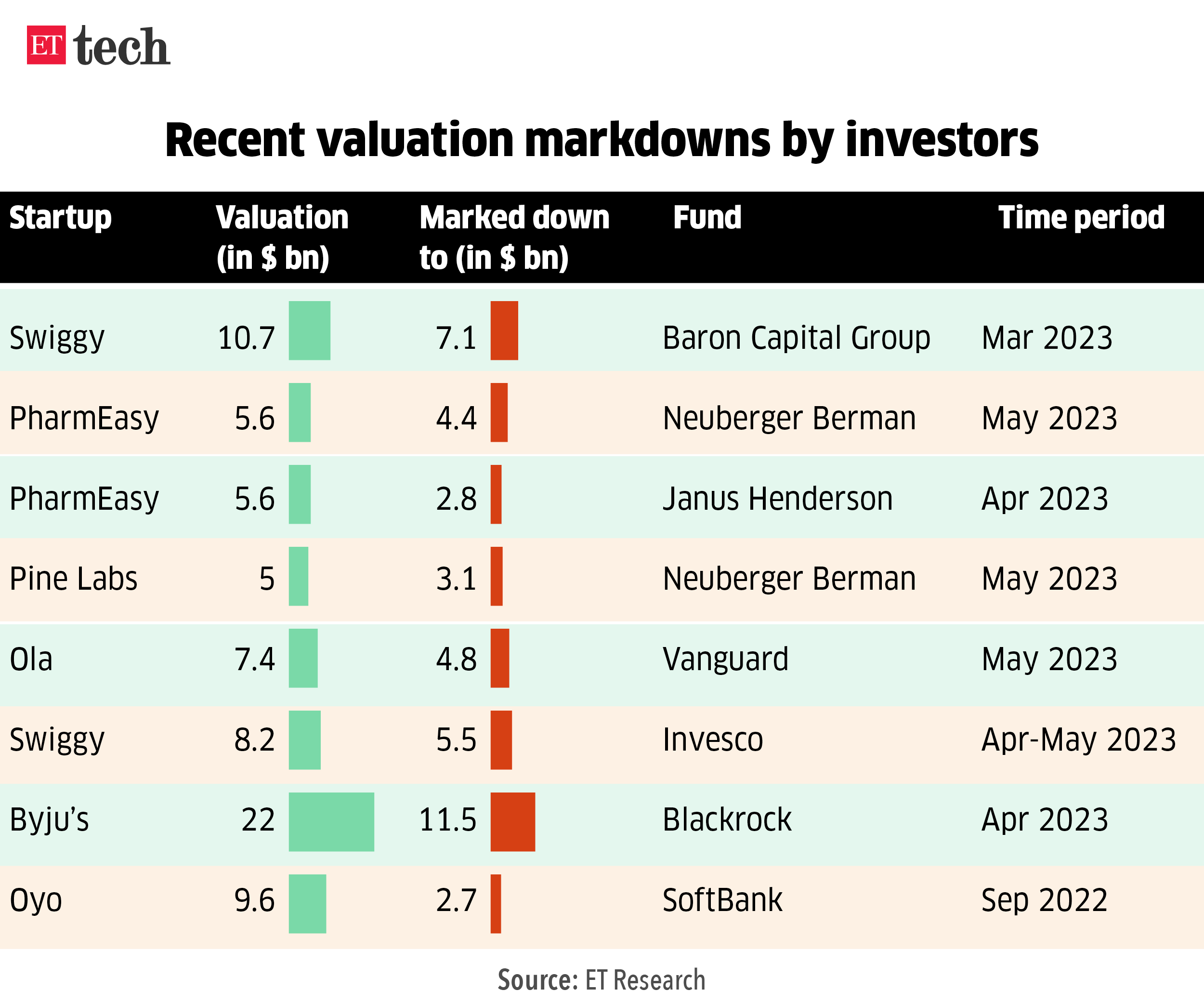

US fund slashes edtech unicorn Eruditus’ valuation by 8.6% to $2.9 billion

Edtech unicorn Eruditus is the latest to be hit by a valuation markdown in the tech sector.

Driving the news: The Private Shares Fund, a New York-headquartered firm focusing on investments in late-stage venture-backed private companies, has reduced the valuation of its holding in Eruditus by about 8.6%, resulting in its valuation dropping from $3.2 billion in August 2021 to about $2.9 billion as of March 31, 2023. This is the price at which the Mumbai-based startup had last raised equity-based capital from investors including The Private Shares Fund.

Tell me more: The Private Shares Fund pegged the fair value of its 36,264 shares at about $4.66 million in its financial update to the Securities and Exchange Commission (SEC) of the quarter ended March 2023.

ET Ecommerce index

We’ve launched three indices – ET Ecommerce, ET Ecommerce Profitable, and ET Ecommerce Non-Profitable – to track the performance of recently listed tech firms. Here’s how they’ve fared so far.

Other Top Stories By Our Reporters

Digital consumer brand Atomberg raises $86 million in funding from Temasek, Steadview: The company, founded by IIT Bombay alumni – Manoj Meena and Sibabrata Das – will use the fund infusion to boost manufacturing capabilities, support new product launches, deepen offline presence across key regions.

Bigbasket cofounder’s LaundryMate raises $6.25 million in funding from Blume Founders Fund, others: LaundryMate, an online laundry services startup founded by Bigbasket cofounder Abhinay Choudhary, raised Rs 50 crore ($6.25 million) from Blume Founders Fund and others.

Healthtech startup Qure.ai appoints Poonam Ajgaonkar as chief people officer: Ajgaonkar’s expertise will be instrumental in attracting and retaining top talent, enhancing employee engagement, and fostering an inclusive work culture globally, the company said.

Global picks we are reading

The odd appeal of absurdly long YouTube videos that play nothing on purpose (The Verge)

Waluigi, Carl Jung, and the Case for Moral AI (Wired)

How Nvidia created the chip powering the generative AI boom (Financial Times)

[ad_2]

Source link