[ad_1]

Also in this letter:

■ Coca-Cola to acquire minority stake in food delivery platform Thrive

■ Deep Dive: What’s next for India’s NFT economy

■ Whatever you do will get scrutinised: outgoing TCS CEO

Payment gateway access may be blocked for online games

As online gaming companies and the government take a step closer to the implementation of a self-regulatory mechanism for the sector, the IT ministry is planning to close loopholes that could potentially let illegal betting and gambling platforms to flourish, as per sources in the know. The move, however, is aimed to make sure that whitelisted games do not face issues from banks and payment gateways.

What’s next? Government officials told ET that the Ministry of Electronics and Information Technology (MeitY) will likely issue a set of orders for financial services companies asking them to disallow their payment gateways for games that are not ‘permissible’ by the self-regulatory organisations (SROs). This is expected to further help the authorities in cracking down on operations of illegal online betting and gambling companies.

The background: MeitY has notified the online gaming regulations, asking the industry to set up SROs with a diverse set of individuals who will be responsible for certifying online games as permissible or non-permissible. The government has said that online real money games that allow wagering on an outcome are not allowed under the law, in addition to those that have the potential to cause user harm, financial fraud or addiction.

Tell me more: Payments industry executives said over the past few months, banks and fintechs have proactively started blocking access to payment gateways which are operating in the regulatory grey areas. ET reported last week that GST authorities have clamped down on some overseas entities offering online gambling and betting, with some of them said to be posing as fantasy game ventures.

Adjacent impact: Last week, minister of state for electronics and information technology Rajeev Chandrasekhar said in a Twitter Spaces session that advertising of non-permissible games, whether in a surrogate form or otherwise, would also not be allowed as per the new rules.

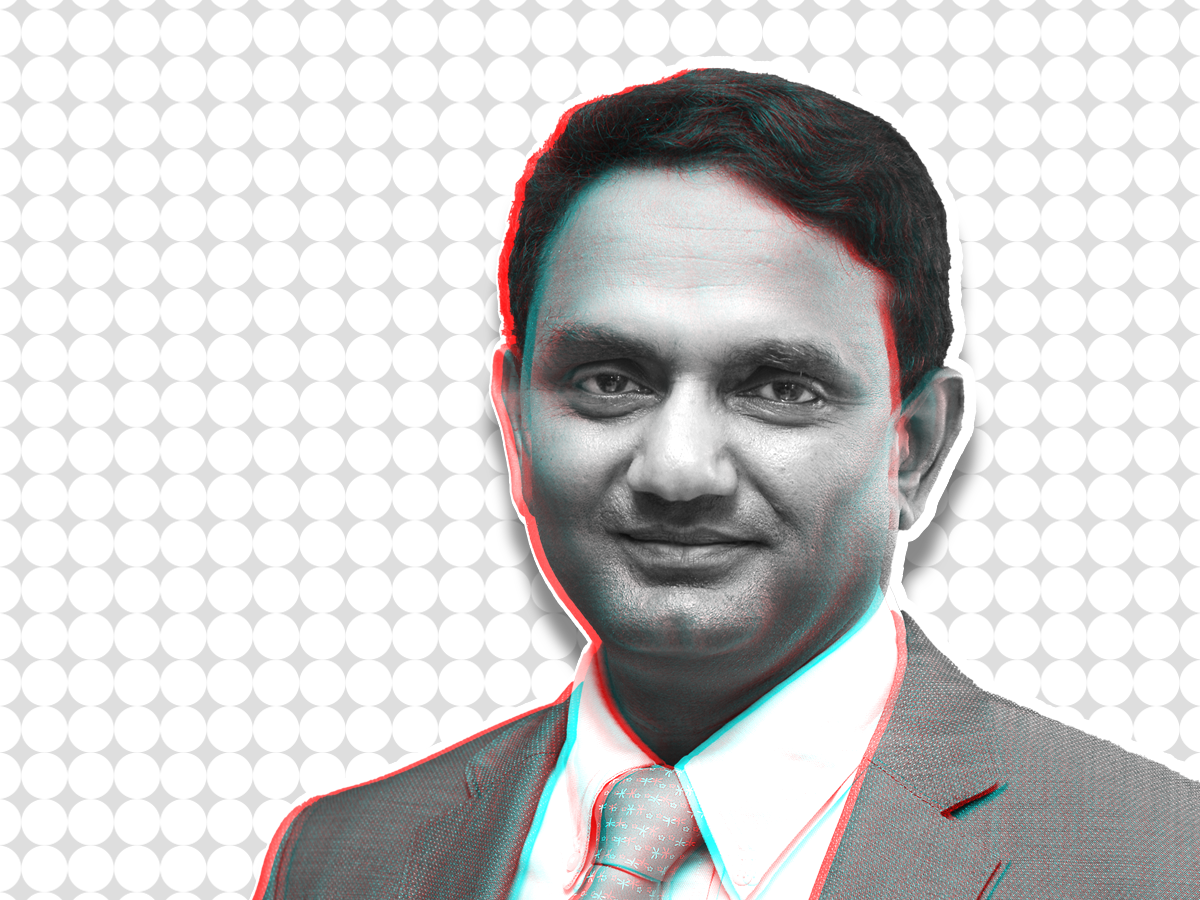

Won’t forego margins for growth: TCS CEO-designate K Kirthivasan

Tata Consultancy Services’ (TCS) CEO-designate K Krithivasan offered reassurance that the global macroeconomic difficulties affecting technology companies won’t materialise into a genuine crisis. Here are a few excerpts from the interview.

TCS has been criticised for growing slower than Infosys despite being almost twice the size. How do you react to this?

We are very comfortable with our business model. Our model is going to be primarily asset light. We are focused on particular margins and aspirations, so we will work towards that.

What is your long-term vision for TCS?

I’m not going to give you any grand statement because our focus has always been culture and values which will not change. The fundamental pillars are going to be our customers and our associates.

What is your strategy to continue growing in such uncertain times?

During uncertain times. customers are focused on controlling and reducing costs. So, it’s important to go to them and tell them proactively, if you do ( this) your spend will reduce and that could be spent on your transformation. So, our teams should and will go to the customers and say- these are the opportunities we see, where you can optimise and save and then enrich. That’s always been the approach.

In this job, you can’t just do something (without explaining): outgoing TCS CEO on stepping down

Rajesh Gopinathan, the outgoing CEO of India’s largest software exporter TCS, said there may be ‘some angst’ about the company’s new operating model, and that it is understandable. In an interview, Gopinathan talked about stepping down from his role, TCS’s slowing growth and rising importance of the UK as a market. Here are the edited excerpts.

There is a lot of uncertainty on technology spending. How do you expect this financial year to pan out?

If you look at different markets, the UK has been the most vibrant. Both cost takeout and transformation deals are happening and people are trying to position themselves for the future. So we do work with JLR significantly going onto the electric side. Utilities are going through a lot of transformation and really pushing the consumer choice agenda and the same applies to railways. So the UK has been accelerating through the year.

After you decided to quit, a lot was said about why you’re leaving. What is your reaction to such concerns?

I have absolutely no reaction to it. TCS is the second largest listed company. This is a public role. So whatever you do will get scrutinised. When you spring a surprise on people, everybody will have their point of view and you will get the full spectrum of views. I’m not surprised because everyone tries to rationalise it in their own way.

Coca-Cola to acquire minority stake in food-ordering platform Thrive

The global beverage-making company Coca-Cola is about to buy a small stake in Thrive, an online food ordering startup. Thrive competes directly with Swiggy and Zomato and boasts of partnerships with over 5,500 restaurants. This will be Coca-Cola’s first investment in a startup in India.

What’s in it for Coke? Coca-Cola’s investment in Thrive is expected to give the beverage maker an edge as it will push consumers to order only Coca-Cola’s beverages along with the food orders they place on the Thrive app, an executive aware of the development told ET. It will drive consumer engagement for the beverage maker with both restaurant and consumers, and give it access to consumer data since Thrive has a large base of mid-sized restaurant partners offering diverse cuisines, he added.

Dominos’ investment: In late 2021, Domino’s operator Jubilant FoodWorks had acquired a 35% stake in Thrive for around Rs 24.75 crore, a move it had then said would help it push direct deliveries to consumers as well as give it access to consumer data.

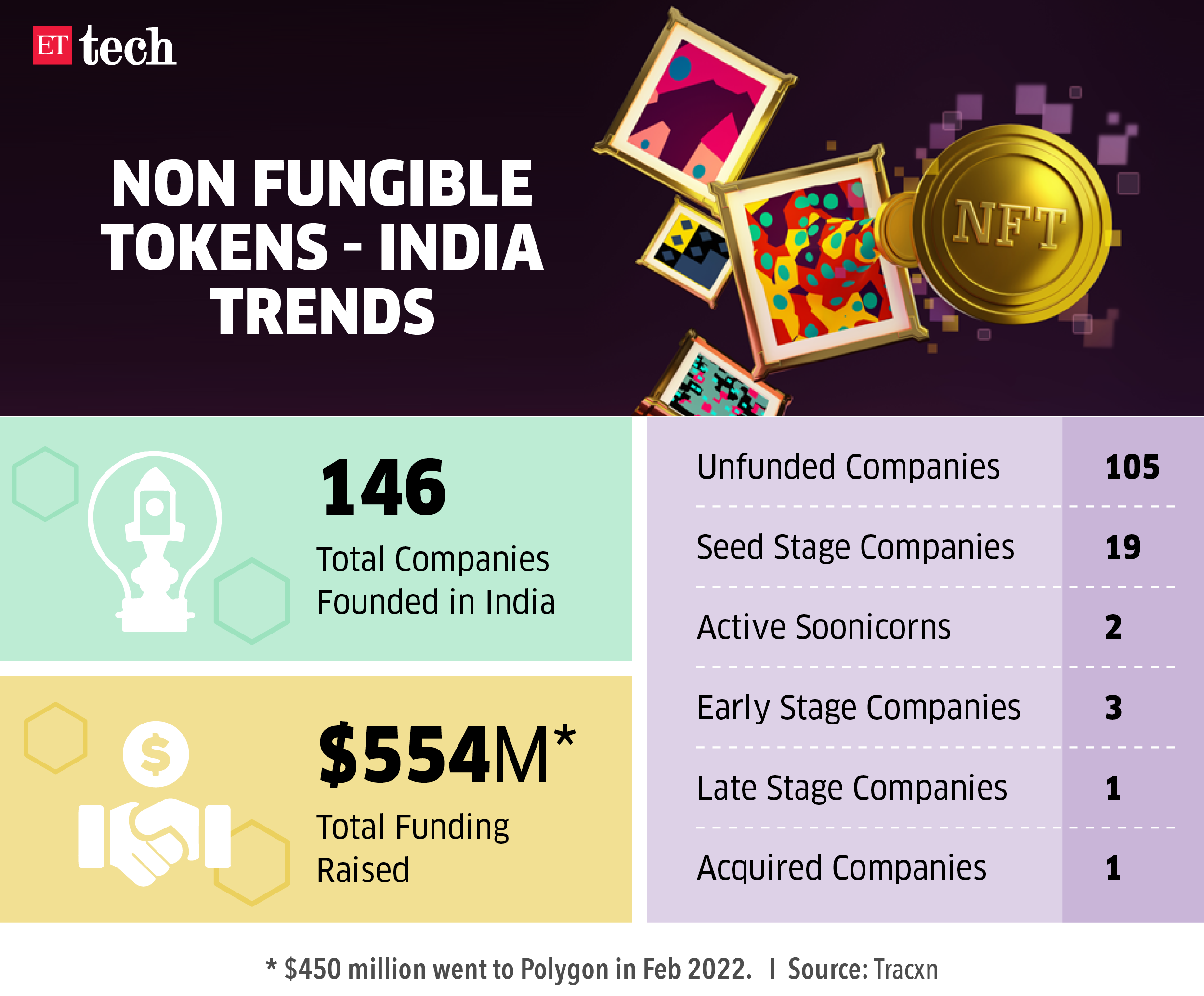

Deep Dive: What’s next for India’s NFT ecosystem

The super-short history of NFTs has been chaotic — from the dizzying heights of hype to a bone-rattling decline in the wake of a crypto shakedown to a quick correction, a quiet realisation and, now, a pivot to utility.

The boom and bust of NFTs: After an NFT-backed piece of art by American digital artist Mike Winkelmann aka Beeple, Everydays: The First 5000 Days, sold for $69 million at a Christie’s auction in 2021, NFTs went from relative obscurity to widespread popularity. That year, NFT sales volume increased dramatically to $24.9 billion, according to market researcher DappRadar.

Crypto ecosystem began to feel the heat by the summer of 2021 when cryptocurrency Luna collapsed. Crypto lender Celcius followed. By the end of 2022, FTX one of the largest crypto exchanges, also collapsed.

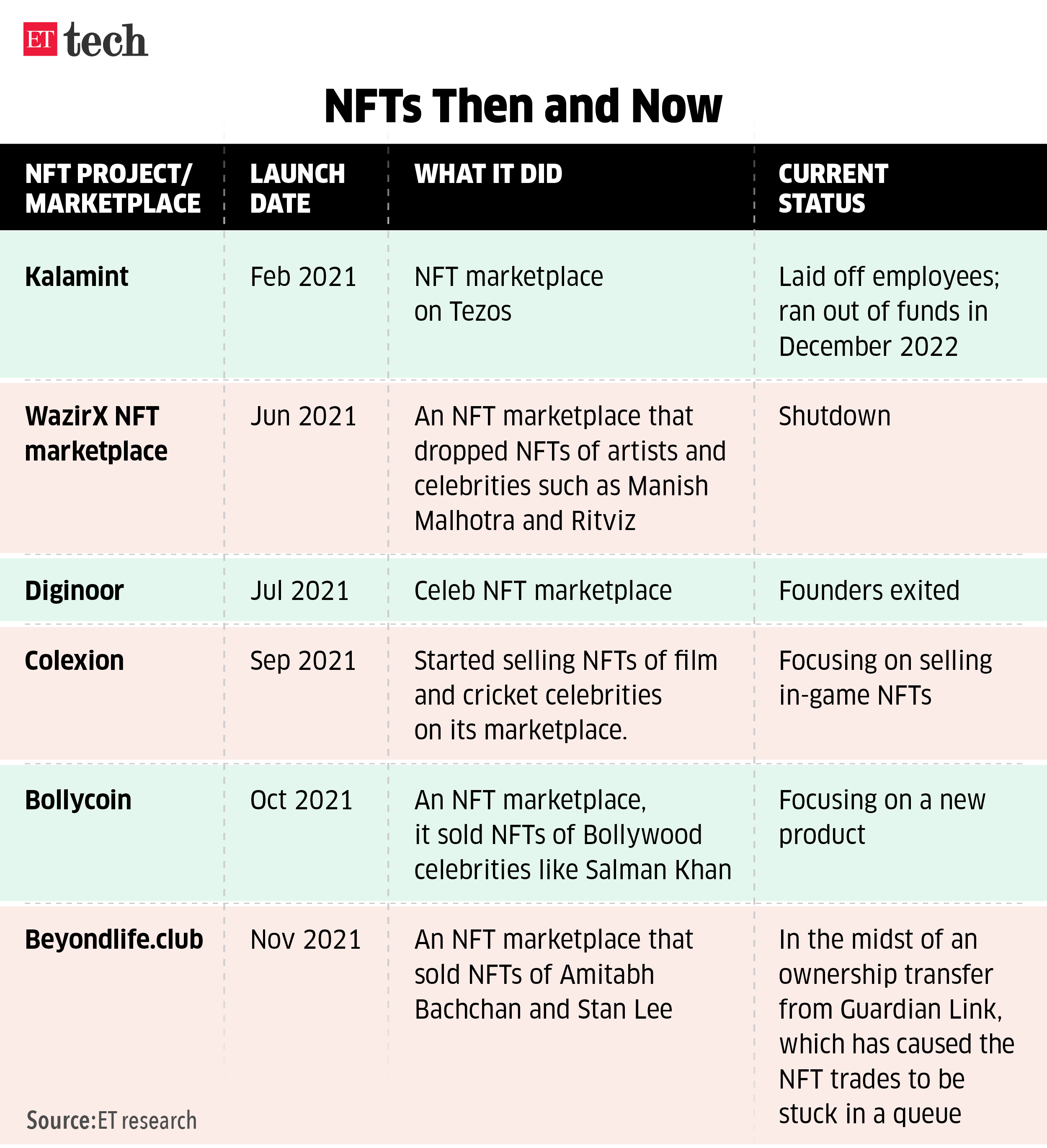

India in NFTs: India’s first NFT marketplace Kalamint, which was launched in February 2021 and climbed to the top 20 in seven months, ran out of funds in December last year amid falling trading volumes. Crypto exchange WazirX also shut down its marketplace in February amid falling transaction volumes. The company said monthly transactions had dropped to $112.24 and it had made just about $6 in fees while server expenses ran into thousands of dollars.

New chapter: A few NFT platforms have survived the bear market and are seeing consistent user growth. Tiger Global Capital-backed Fancraze and Dream Capital-funded Rario are trying to tap the cricket fan base. Future NFT projects will be community focused, say experts, and could look beyond the arts. Some startups are using the technology to grant memberships or bundle software.

Tweet of the day

Crypto exchanges to report VDA transactions, beneficial owners under regulatory guidelines

In a new set of guidelines, India’s Financial Intelligence Unit has sought to further regulate crypto exchange platforms, people in the know told ET. The guidelines follow the March 7, 2023 finance ministry notification bringing transactions relating to VDAs under the Prevention of Money Laundering Act (PMLA).

What are the changes: All cryptocurrency exchanges and providers of services related to virtual digital assets (VDAs) would have to determine the true ‘beneficial owners’ of wallets where VDAs are stored, report all VDA receipts worth Rs 10 lakh or more by NGOs and non-profits, and terminate business relationship with ‘politically exposed persons’ if there are hurdles in carrying out ‘enhanced due diligence’ of such dodgy customers.

Eyes on wallets: Withdrawals of cryptos from wallets hosted by a local exchange to an `unhosted wallet’ beyond the jurisdiction of domestic law enforcement agencies has been a challenge for the Enforcement Directorate (ED), since crypto platforms have been allegedly used among others by entities linked to unauthorized loan Apps, backed by Chinese nationals, to transfer funds out of India after converting the money recovered from usurious lending schemes into cryptocurrency.

Other Top Stories By Our Reporters

Arzooo has first mover advantage despite ONDC: Celesta Capital managing partner | Retail technology company Arzooo, that helps small retailers compete with ecommerce giants like Amazon and Flipkart has a first mover advantage in the space, despite the entry of government-backed Open Network for Digital Platform (ONDC) that intends to democratise ecommerce, said Celesta Capital’s managing partner Sriram Viswanathan.

The great churn: Tech majors bring in new leadership amid course correction | The last few months have seen unprecedented churn at the $245 billion Indian IT industry, to say the least.There have been even more vertical or business unit heads and country managers who have moved on to other tech firms in C-suite positions.

Global Picks We Are Reading

■ How Bookshop.org Survives—and Thrives—in Amazon’s World (Wired)

■ What’s it like to use a $300 Windows laptop for a day? (The Verge)

■ African startups need more than just funds from their investors (Rest of World)

[ad_2]

Source link