[ad_1]

Also in this letter:

■ Global funding of Indian startups may pause: RBI to Parliamentary Panel

■ Capillary Technologies acquires Brierley from Nomura

■ Apple to cut small number of jobs: Report

PhonePe’s local commerce app Pincode goes live on the ONDC network

From left: PhonePe cofounders Rahul Chari and Sameer Nigam

Walmart-owned fintech major PhonePe has announced the launch of Pincode, an app built on top of the government-backed ONDC platform. The app will have a pilot in Bengaluru with categories such as grocery, food, pharma, electronics and home decor, a statement from the company said.

About the app: The Pincode app hopes to promote local shopkeepers and sellers and digitally connect each city’s consumers with all the neighbourhood stores that they usually buy from offline.

Why a separate app? According to PhonePe CEO Sameer Nigam, the company opted to launch a separate app instead of having an ONDC store on PhonePe itself due to the large volume of orders. Mixing ecommerce with existing digital payment activities was not something the company was willing to do.

Longstanding aspiration: The fintech player’s online commerce ambitions aren’t new. ET had reported in August last year about its plans to enter the ecommerce space. The fintech previously made attempts to enter the space with Switch, loosely based on the super app concept, and Stores, which was aimed at facilitating the hyper-local discovery of merchants. The company had earmarked up to $15 million for its ONDC entry and was planning to deploy the capital over 18 months.

Quote unquote: “It (ecommerce) is somewhere between moonshot – because of ONDC – and a very large market to tap into… The opportunity is larger than payments but it is much riskier… because nowhere in the world any government or industry has aggregated so many aspects of fulfilment – logistics, inventory management, seller and buyer platforms among others,” Nigam had told ETtech in August last year.

Global funding of Indian startups may pause: RBI to Parliamentary Panel

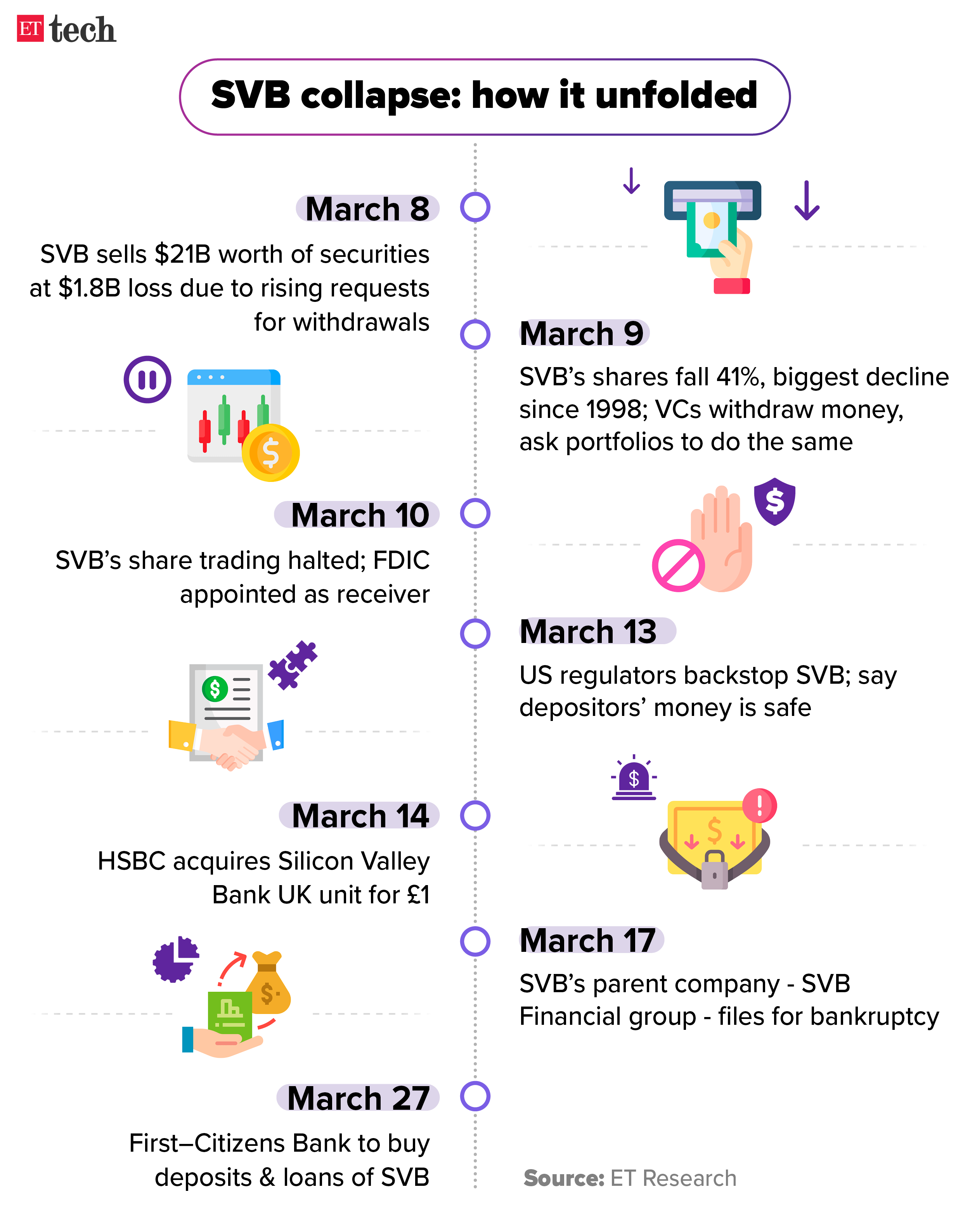

The Reserve Bank of India (RBI) told a parliamentary panel that the recent collapse of Silicon Valley Bank (SVB) may lead to a temporary interruption in the availability of global funds for Indian startups.

‘Limited impact’: The central bank was represented by department of financial services secretary Vivek Joshi, RBI executive director Ajay Kumar Choudhary, SBI MD Alok Kumar Choudhary, officials from the Department for Promotion of Industry & Internal Trade (DPIIT) and the Indian Venture & Alternate Capital Association (IVAC).

The RBI team assured the parliamentary standing committee on finance, chaired by BJP MP and former minister of state for finance Jayant Sinha, that the impact of the bank’s collapse on the Indian startup ecosystem appears to be “limited”.

Also read | Silicon Valley Bank collapse and how it impacted Indian startups: all the top stories

The central bank said that due to rate hikes and tightening liquidity conditions globally, the venture capital industry was reducing or re-evaluating investments.

Quote unquote: “The committee had a very engaging set of discussions on the collapse of important financial institutions in the US and Switzerland, and analysed their implications for India’s financial system and startups,” Jayant Sinha, chairman of the standing committee on finance, said.

Also read | Indian startups move dollars to Gift City, other countries from SVB bank

Need for specialised financial services: Sinha said there was wide agreement among the members and officials that there is a need for specialised financial services for Indian startups. Many of India’s financial institutions are setting up specialised branches and products for startups, he added.

Capillary Technologies makes fifth buy, acquires Brierley from Nomura

Customer engagement software provider Capillary Technologies on Tuesday announced the acquisition of Texas-headquartered Brierley+Partners, which provides loyalty solutions to global brands, from Japan-based Nomura.

Details: The acquisition will help Capillary expand its loyalty offerings through Brierley, leverage the latter’s Emotional Loyalty Quotient platform to drive value, and cross-sell newer products to existing clientele with an improved suite of offerings.

Fifth acquisition: This is Capillary’s fifth acquisition globally and second in the United States, in line with its efforts to expand into the North America market. In the past the company had acquired US-based customer experience firm Persuade; machine learning startup Ruaha Labs, and digital commerce solutions provider MartJack. It has also invested in other startups, including customer relationship management (CRM) software provider WebEngage.

IPO plans: The company was looking to list on the Indian bourses last year and had filed draft documents to raise Rs 850 crore through a public listing.

ETtech Done Deals

Dozer raises $3 million in funding, emerges from stealth mode: Dozer, an open-source data infrastructure platform that helps software engineers create application programming interfaces (API), on Tuesday said it has raised $3 million in a seed round of funding and also emerged from stealth (the platform has opened access to developers).

Zyod raises $3.5 million in funding: Zyod, a business-to-business fashion ecommerce marketplace for apparel sourcing and manufacturing, said it has raised $3.5 million in seed funding in a round led by Lightspeed Venture Partners. The startup plans to use the funds to improve technology and hire more people.

SaaS buying platform Spendflo raises $11 million in funding led by Prosus, Accel: Software-as-a-Service (SaaS) buying and management solution Spendflo on Tuesday said it has raised $11 million in a Series A funding round led by Prosus Ventures and Accel.

Tweet of the day

Apple to cut a few jobs in some corporate retail teams: report

Apple Inc is eliminating a small number of roles within its corporate retail teams, Bloomberg News reported on Monday, citing people familiar with the matter.

The layoffs would impact what Apple calls its development and preservation teams, the report said, adding that the number of positions being eliminated could not be ascertained and was likely very small.

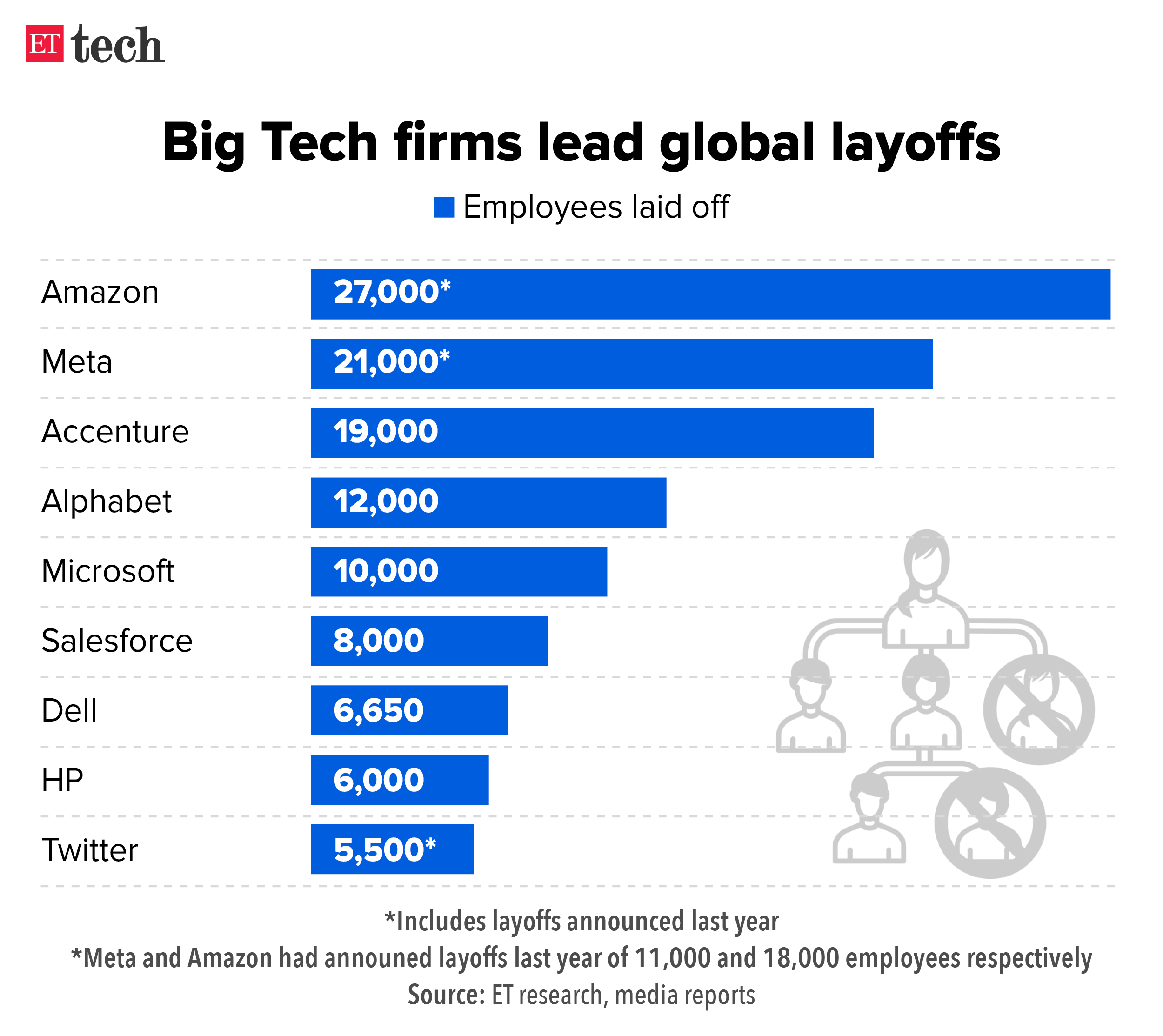

Worries about an economic downturn due to rising interest rates have sparked a series of mass job cuts across corporate America in recent months.

Walmart to cut over 2,000 jobs: Walmart will cut more than 2,000 jobs at five US ecommerce warehouses, Bloomberg reported on Monday. The layoffs include more than 1,000 roles at a warehouse in Fort Worth, Texas, along with 600 jobs at a Pennsylvania fulfilment centre, 400 in Florida and 200 in New Jersey, the report said, citing regulatory filings, with additional reductions planned in California.

Also read: Layoffs 2023: Tech companies that laid off the most employees

Layoffs in 2023: The layoff wave has swept not only startups and mid-sized firms, but also big tech companies such as Amazon, Microsoft, and Google parent Alphabet, among others. So far, 553 tech companies have laid off 1,66,004 employees in 2023, according to tracking site Layoffs.fyi.

Elon Musk replaces Larry Bird with ‘Doge’ meme

Twitter CEO Elon Musk is back with new updates for the social media site. This time, he has booted out Larry Bird, the microblogging site’s iconic blue bird, a logo that serves as a home button on its web version, with a ‘doge’ meme for the Dogecoin cryptocurrency.

On Monday, Twitter users noticed the ‘doge’ meme, part of the logo of the Dogecoin blockchain and cryptocurrency, which was created as a joke in 2013, on the web version of Twitter. Notably, there was no change on Twitter’s mobile app.

‘As promised’: The Twitter CEO also shared the screenshot of the March 26, 2022, conversation he had with the anonymous account, where the latter asked for the bird logo to be changed to the ‘doge’. Sharing the conversation on Twitter, Musk wrote, “As promised.”

Dogecoin soars: Musk, who bought Twitter last fall in a $44 billion deal, is a well-known superfan of the Doge meme and has promoted Dogecoin on Twitter. He also touted it during his appearance last year as the host of the spoof television show ‘Saturday Night Live’. After the change to Twitter’s web logo Monday, the value of Dogecoin rose more than 28%.

Today’s ETtech Top 5 newsletter was curated by Siddharth Sharma in Bengaluru and Erick Massey in New Delhi. Graphics and illustrations by Rahul Awasthi.

[ad_2]

Source link