[ad_1]

Read our coverage here, here and here.

Mix of old & new: Tata Digital is housed in a building in Fort, a south Mumbai neighbourhood which was once considered the main business district in the island city. You won’t find new-age businesses in this part of town, those are mostly in the Bandra Kurla Complex, commonly known as BKC. But the Tata group has a vast presence in Fort and in south Mumbai with the Bombay House right around the corner.

The Neu office looked busy with a stream of executives across the floor working on the superapp, ahead of the latest season of the Indian Premier League (IPL). Neu was launched almost a year ago piggybacking on the mega cricketing tournament but didn’t really read the pitch right, as we reported earlier this week. The legacy of the Tata group has made Tata Digital cautious about how it spends capital while looking to clock growth. After speaking to several executives aware of Tata Digital’s plan, it’s clear that the ecommerce arm is trying to balance between its startup-like approach while operating with corporate safeguards.

Year gone by: Tata Neu has contributed less than 10% of gross sales to Tata’s two biggest digital assets — egrocer BigBasket and epharmacy 1mg — since launch last April, we reported this week. Since its launch in April, Tata Neu has had several glitches with consumer complaints coming in. The group, as we reported, is now planning a plethora of updates as IPL gets underway.

What’s changing ? The Tata group’s ecommerce team has gone back to the drawing board to revamp the Neu landing page and is considering changes to the superapp’s consumer-fac, according to people privy to the developments

“They (Tata Digital) are working on which Tata products to show on the landing page of Neu. This year, it will also rely heavily on customising based on data from its operations of the last one year,” a source told us.

Mukesh Bansal’s exit: As reported by us first Tata Digital president Mukesh Bansal has left the company less than two years after joining Tata Digital. Bansal, who was building a team full of former Flipkart and Myntra executives, had been in an advisory role for a while now.

What’s next? Neu is hoping it has worked on the consumer feedback over the last one year and can acquire new users and retain them during this year’s IPL. For the Tata group, which has invested over $2 billion in the business, gains from its backend, offline presence and several household brands under its umbrella. But Nue will need to amp up its strike rate– especially when biggies like Amazon and Walmart-owned Flipkart continue to dominate the majority of Indian ecommerce. Meesho, Reliance’s JioMart are among other existing players in the market.

ETtech Exclusives

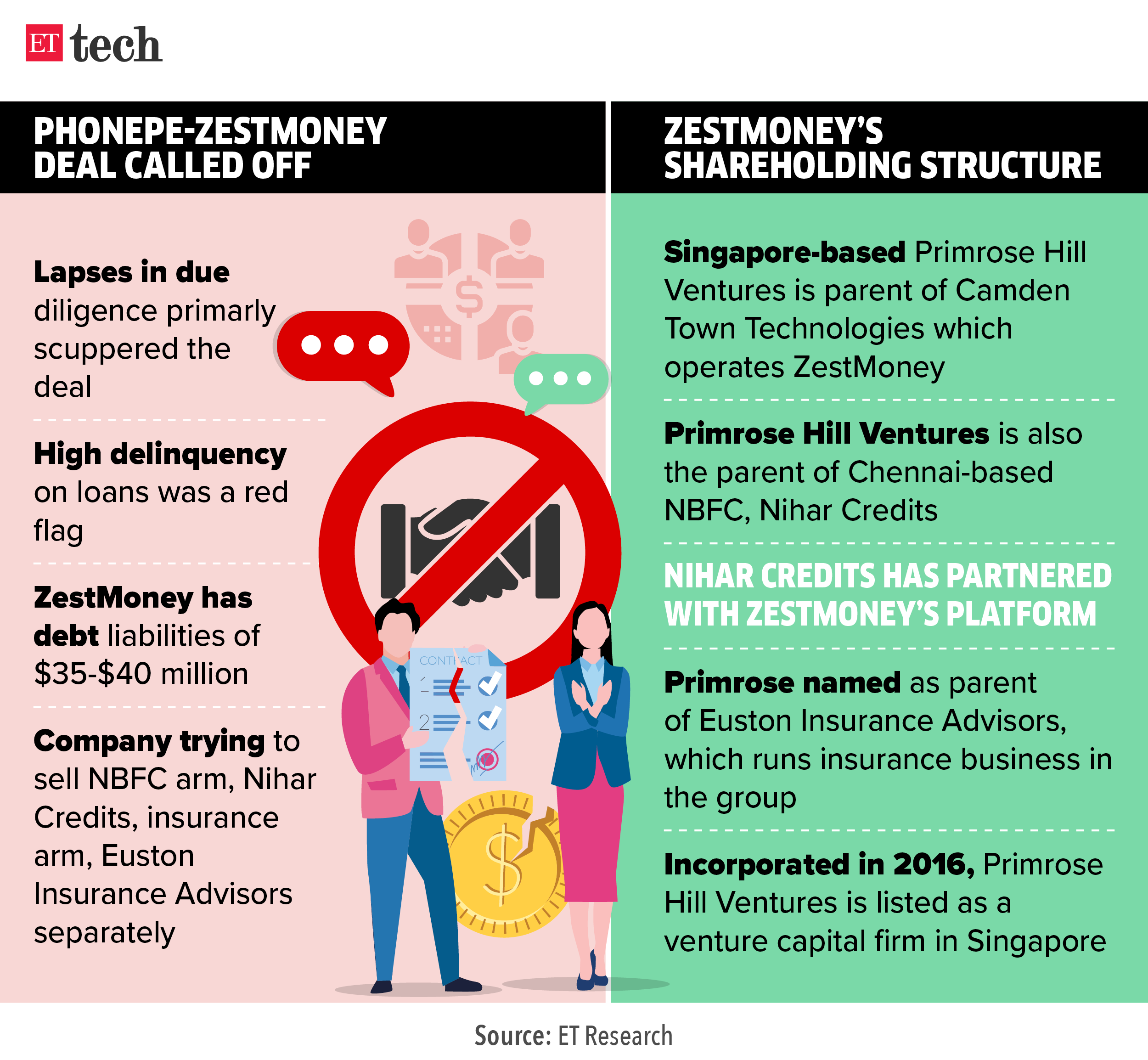

PhonePe calls off deal to acquire ZestMoney: Digital payments major PhonePe is pulling back from a deal to acquire ZestMoney over concerns arising from its due diligence of the buy-now-pay-later (BNPL) platform, people aware of the development told us. PhonePe’s decision to walk out was primarily led by the lapses it discovered during due diligence. This is a big blow for cash-strapped ZestMoney, at a time when funding for technology startups has nosedived globally, and raises questions on its survival.

Also read | Why PhonePe-ZestMoney deal fell through

Swiggy Instamart head to step aside, cofounder to take over: Karthik Gurumurthy, head of Swiggy’s quick commerce business Instamart, will step aside from his current role by the end of April. Swiggy’s cofounder Phani Kishan Addepalli is slated to take over as the head of Instamart, the source added. Gurumurthy, in a Linkedin post on Friday, said that building the business from the ground up, since 2020, had taken a toll on him.

Next nine months will lead to company failures, shutdowns, down rounds: Gokul Rajaram | Silicon Valley-based Gokul Rajaram, a solo capitalist, operator and prolific angel investor who has backed 300 companies said that founders should explore the option of shutting down startups that are unable to find product market fit (PMF) after having raised $10 million or so in funding. Read the full interview here

Tech Policy Updates

NCLAT upholds Rs 1,338-crore penalty on Google by CCI: In a major setback to Google, the National Company Law Appellate Tribunal (NCLAT) has upheld the fine of Rs 1,338 crore imposed on the search giant by the Competition Commission of India (CCI), saying the competition watchdog’s order did not violate the principles of natural justice. Meanwhile, key executives at some Indian startups have said Google may find loopholes to sidestep the fine upheld by NCLAT.

Ecomm, food-delivery firms face fresh trouble as govt may ban related party service: In what could lead to fresh concerns for ecommerce and food-delivery firms, the Indian government may issue rules stipulating that ‘related party’ or ‘associated enterprises’ of internet marketplaces should not sell products or services to a registered merchant on their platforms, multiple people briefed on the matter told us.

Draft rules on online gaming being scrutinised, to be notified soon: MoS IT | Draft rules on online gaming, ready after ‘extensive consultation’, are being scrutinised and will be notified soon, MoS IT Rajeev Chandrasekhar said. Meanwhile, the government has decided to make the tax deducted at source (TDS) on winnings from online games applicable from April 1, instead of July 1 — a move that gaming companies have welcomed, saying it would reduce compliance burdens and potential tax disputes.

Tweet of the day

IPOs, funding, deals & mergers

Oyo pre-files DRHP with Sebi; IPO size likely slashed to $400-600 mn: Oravel Stays, which operates budget hospitality chain Oyo has pre-filed its Draft Red Herring Prospectus (DRHP) with stock market regulator Sebi on Friday under the confidential pre-filing route. The issue size has likely been reduced to $400-600 million, sources said.

Digit Insurance re-files IPO papers after regulator concerns: India’s Go Digit Insurance has re-filed draft papers for a $440 million initial public offering (IPO) after addressing the market regulator’s concerns related to the company’s employee stock plans, which had stalled the offering for months.

Lifelong group-led consortium acquires GoMechanic: Automotive startup GoMechanic, which has been roiled by admissions of misappropriation by its founders, has managed to find a buyer as part of a slump sale. A consortium led by auto component maker Lifelong Group has acquired the company.

EazyDiner raises Rs 40 crore from DMI’s Sparkle Fund: EazyDiner has raised Rs 40 crore ($4.86 million) from Sparkle Fund, a venture capital arm of DMI Alternatives. The startup, present in India and UAE, will utilise the capital to expand its business to 100 cities from 30 currently and for product development, founder Kapil Chopra told us.

ETtech Deals Digest: Late-stage rounds in Lenskart, PhonePe take March funding for Indian startups to $1.14 billion

ET Ecommerce Index

Turbulence at Startups

How startups are cutting cloud costs, renegotiating deals with service providers: As global macroeconomic conditions worsen and funding slowdown continues, Indian startups are cutting their spends on an integral part of tech businesses – cloud storage – by renegotiating contracts with service providers like AWS and Google Cloud, multiple startup founders told us.

Unacademy to slash 12% of workforce; leadership to take salary cuts: Edtech startup Unacademy is cutting 12% of its workforce in another round of layoffs, according to an internal memo by chief executive Gaurav Munjal. A day later, Unacademy on Friday said the edtech firm’s leadership will take permanent salary cuts extending up to 25%.

Other Top Stories By Our Reporters

IT companies cut campus hiring by a third due to slowing economy: India’s top software companies are making up to 30% fewer campus offers this year for the 2023 batch compared with last year.

NPCI sets 1.1% interchange fee on UPI payments via PPIs, wallets: The National Payments Corporation of India (NPCI) has set the interchange fee at 1.1% for merchant transactions initiated using a Prepaid Payment Instrument (PPI) such as mobile wallets on the UPI network. The changes take effect from April 1, according to a circular by NPCI dated March 24.

TCS set for major top-level reorganisation: Tata Consultancy Services (TCS) is poised for widespread reorganisation of its top leadership, including the positions of CTO as well as COO, with top two executives set to retire over the period of the next one year, according to people aware of the matter.

[ad_2]

Source link