[ad_1]

This and more in today’s edition of ETtech Top 5.

Also in this letter:

■ Cricketer Deepak Chahar, wife Jaya float sports tech venture

■ Glance surpasses 30 million users in Indonesia, Roposo launch soon

■ IMF lays out crypto action plan, bats against legal tender status

Amazon to board ONDC with logistics, SmartCommerce offerings

Amazon said it will integrate its logistics network (from pickup to delivery) and SmartCommerce services with the government-backed Open Network for Digital Commerce (ONDC).

Details: Amazon said the move aims to provide greater technology support to the seller community and further empower small businesses.

The company also plans to digitise one crore small businesses by 2025 and deliver across 100% of serviceable pin codes.

“We are excited about the opportunities to mobilise Amazon’s industry-leading infrastructure and technology, including logistics, and small business digitisation tools, to help the ONDC accelerate its objectives. We remain committed to being a catalyst for India’s digitisation efforts throughout the economy,” said Amazon India country manager (consumer business) Manish Tiwary.

ONDC’s expansion plans: The government-backed network is currently operational in a beta-testing mode in 15 cities across India. ONDC is targetting 5,000 transactions a day by the end of March from the current 200, its chief executive T Koshy had said at the Kotak institutional investors’ conference recently.

Over 18,000 merchants across product categories of groceries, food and beverages, and home decor are live on ONDC in more than 150 towns and cities, Koshy had said, adding that 35 apps were live and over 400 were being integrated.

Cricketer Deepak Chahar, wife Jaya float fantasy sports app

Cricketer Deepak Chahar, along with his wife Jaya Chahar, has floated a sports tech venture JCDC Sports, which has rolled out a fantasy sports gaming platform TFG (Trade Fantasy Game). The app will be available on both iOS and Google Play Store.

Roles: Deepak will be the brand ambassador of the platform, while Jaya, who has been a media professional, will manage the operations of the company as its founder and CEO.

Features: The cricketer, who represents CSK in the IPL, said the unique feature on the platform is that users will have to build fantasy teams with only six players compared to other apps which allow users to create a fantasy team with 11 players. He also said that TFG will reward users who are loyal and play frequently on the platform. “We are in this business for the long haul and our aim is to be at the top,” he said.

Target: Jaya said the company is targeting 1 million downloads for the fantasy sports app by FY24. “Our revenue target is Rs 18 crore by FY25. We aim to be EBITDA positive from the third year,” she said.

TWEET OF THE DAY

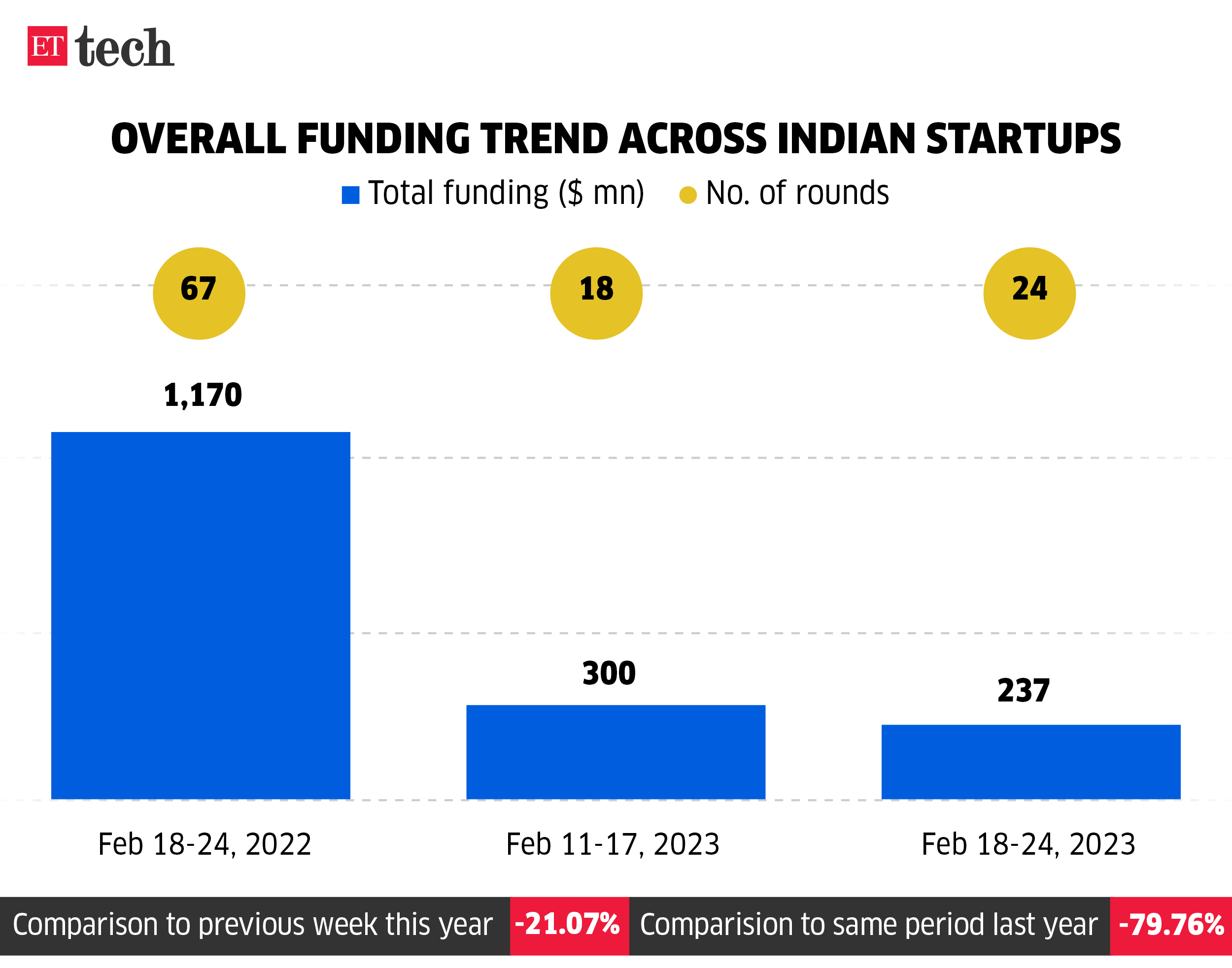

ETtech Deals Digest: Funding for Indian startups dropped 79% YoY this week

The funding slowdown in Indian startups continued during the week of February 20 and 24 as venture funding dropped by 79% year-on-year to over $250 million.

During the same week last year, Indian startups had raised $1.17 billion in venture funding across 67 rounds, according to data provided by market intelligence firm Tracxn.

On a weekly basis, this is around 17% lower than the previous week when startups saw total funding of around $300 million across 23 rounds.

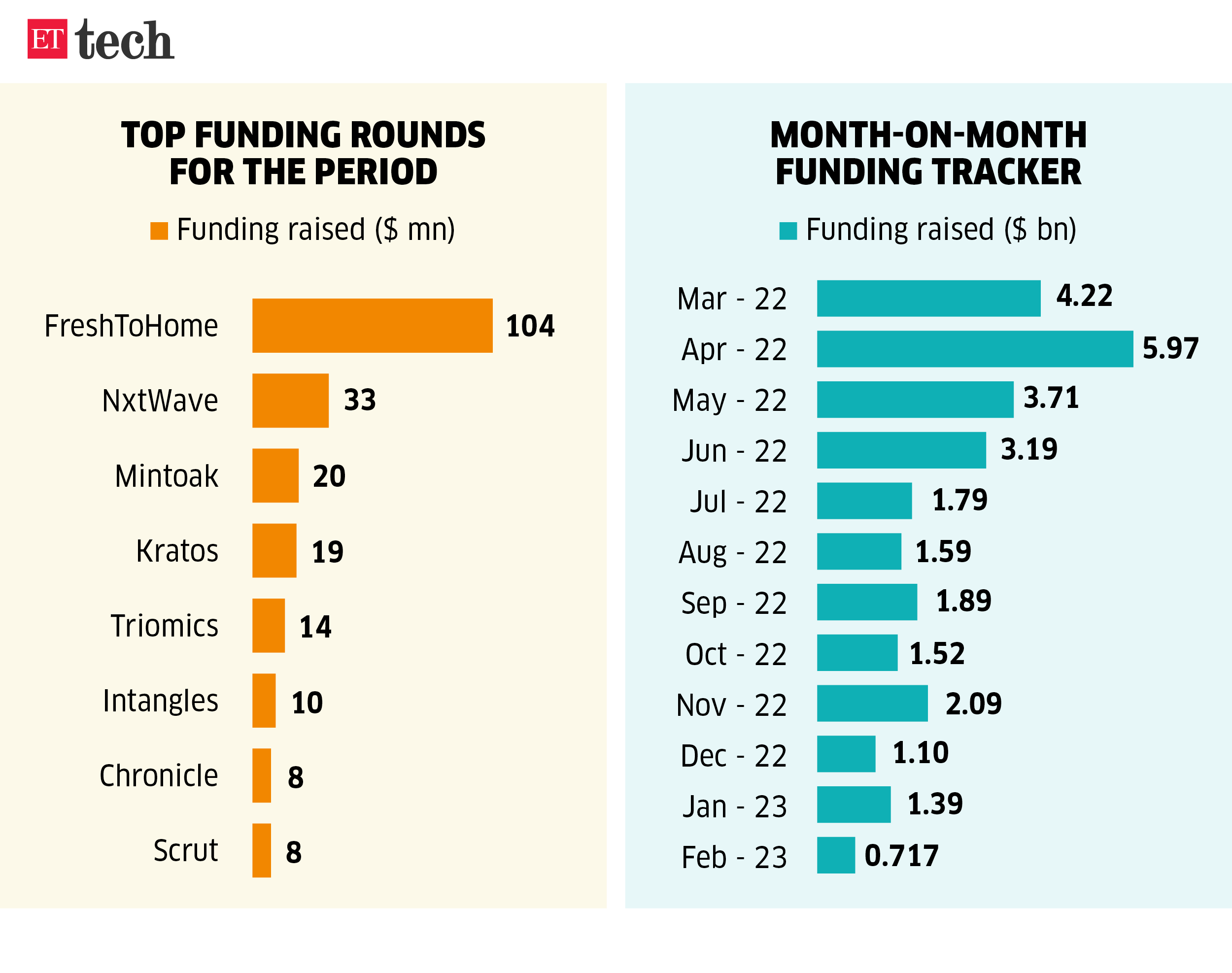

Like PhonePe’s funding round earlier this month, meat delivery startup FreshToHome emerged as an exception to the ongoing funding winter. It raised $104 million in a new funding round, led by Amazon Smbhav Venture Fund.

During the week under review, funding rounds of upskilling platform NxtWave’s – which raised $33 million and Software-as-a-Service (SaaS) startup Mintoak – which raised $20 million – were among the bigger rounds.

Here is a list of startups that raised money this week:

Glance surpasses 30 million users in Indonesia; to launch Roposo

Glance, a Google and Reliance Jio backed Indian social media firm, is planning to expand its services in Indonesia, and launch its live platform Roposo in the upcoming quarter, Piyush Shah, co-founder of InMobi Group and president and COO of Glance, told ET. Roposo will add creator-driven live content on lock screens, he said.

Nostra: Glance also plans to offer more gaming and live game streaming, by its gaming platform Nostra. This year, Nostra’s user base is expected to double in Indonesia, Shah said. Additionally, Nostra aims to expand its games library from 400 games to 1,000 this year through partnerships with gaming studios and developers worldwide.

“This creates a huge opportunity for Indonesia’s talent pool of game developers, to build and scale games through presence on lock screen – not just in Indonesia, but across Nostra’s other markets as well,” he said.

Quote unquote: “Over the past six months, our top three categories in Indonesia – entertainment, games, and technology content – have garnered 626 million, 591 million and 411 million video views, respectively. Whether it’s news, entertainment, live gaming, or health and fitness content, consumers are finding engaging, personally relevant experiences on Glance,” Shah told ET.

Monthly active users: Glance crossed 30 million monthly active users (MAU) in Indonesia and over the next one year, the MAU is expected to cross 50 million in the next four to six quarters in Indonesia.

IMF lays out crypto action plan, recommends against legal tender status

The International Monetary Fund (IMF) has laid out a nine-point action plan for how countries should treat crypto assets, with point number one a plea not to give cryptocurrencies such as bitcoin legal tender status. It said such efforts have become a priority for authorities after the collapse of a number of crypto exchanges and assets over the last couple of years, adding that doing nothing was now “untenable”.

Key recommendation: The top recommendation was to “safeguard monetary sovereignty and stability by strengthening monetary policy frameworks and do not grant crypto assets official currency or legal tender status.” Other advice included guarding against excessive capital flows, adopting unambiguous tax rules and laws around crypto assets, and developing and enforcing oversight requirements for all crypto market actors.

US regulators warn banks to be on alert: Top US banking regulators issued a fresh warning to banks to be on guard for any liquidity risks from cryptocurrency-related clients, cautioning some of their deposits could prove volatile.Regulators said the new statement was spurred by “recent events” in the crypto sector that highlighted volatility risks.

While they noted the statement does not include new requirements and banks are not prohibited from providing services to particular sectors, it does mark the latest in a series of moves from bank regulators urging caution in any crypto dealings.

Today’s ETtech Top 5 newsletter was curated by Megha Mishra in Mumbai and Erick Massey in New Delhi. Graphics and illustrations by Rahul Awasthi.

[ad_2]

Source link