[ad_1]

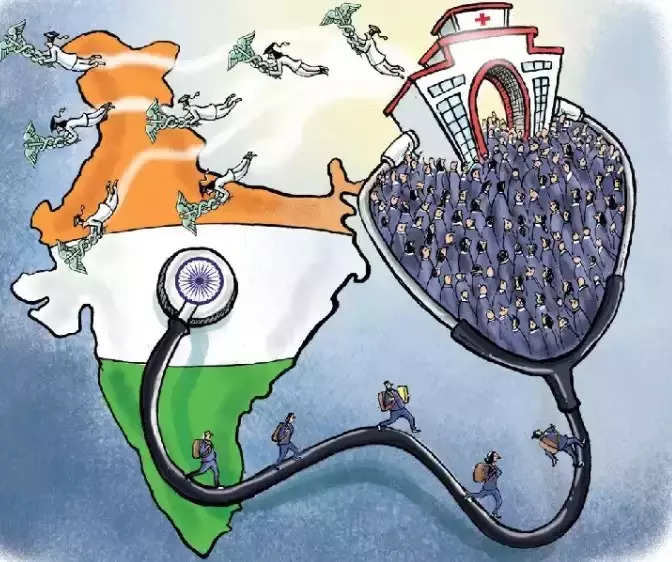

New Delhi: Finance Minister Nirmala Sitharaman’s forthcoming budget to be presented in Parliament on February 1, 2023, is a much anticipated one particularly in the healthcare domain. Sharing budget recommendations, Lalit Mistry, Partner and Co-head, Healthcare sector, KPMG in India informed that the Union Budget 2023-24 for the healthcare sector should be drafted keeping in mind the long-term vision for building a ‘Healthy India’ with sustainable healthcare infrastructure and healthcare workforce.

Speaking to ETHealthworld, Mistry said, “There is a need to increase the budget by a minimum of 30 to 35 per cent focusing on the below five priority areas: health insurance of India’s missing middle, establishing a healthcare infrastructure fund, tax benefits for healthcare skilling and development, tax benefits on preventive health check-ups and incentivisation for digitisation in the healthcare sector.

The Indian healthcare sector requires a comprehensive sector development programme under the Government of India (GoI) to foster private sector investment, medical education infrastructure development, support structured financing at low cost, drive digitisation in the healthcare sector, a roadmap towards universal healthcare coverage, and cohesive efforts of private and public sector towards building a ‘Healthy India’. Union Budget 2022-23, the Government of India allocated around Rs 86,200 crore to the Ministry of Health and Family Welfare (MoHFW) 16.5 per cent increase compared to the previous year.

Health insurance of India’s missing middle: Comprehensive insurance model to cover the missing population – In 2021, as highlighted by the Niti Aayog report titled ‘Health Insurance of India’s Missing Middle’, a population of around 40 crore individuals are still devoid of any financial protection. Although in 2022, the government took the initiative of extending AB-PMJAY coverage to senior citizens (women above the age of 65 and men above 75 years) but still, there is an urgent need for developing health coverage and financing models under AB-PMJAY to provide mandatory health coverage to rest of the missing population.

Establishing a healthcare infrastructure fund: Micro, small and medium enterprises (MSMEs), start-ups, and medical device parks are some of the areas in which the government has set up dedicated funds and schemes to support infrastructure development. In the last few years, there have been fewer new medical colleges in the private sector, and the recent capping on fees has further limited the interest of the private sector to set up medical colleges. Central and state governments can establish a healthcare fund to provide them with low-cost capital, support with dedicated viability gap funding for PPP projects, subsidies for medical equipment, and financial benefits such as land at a concessional rate for the development of projects across tier-II-III cities.

Tax benefits for healthcare skilling and development: As per the Income Tax Act, 2013-Section 35CCD, for computing business income, a manufacturing company is allowed a weighted deduction of 150 per cent of expenses (other than land or building) incurred on a skill development project, allowing manufacturers to recover the money invested on the skill development needed for their industry. These fees may also be repaid to the company in cash returns rather than tax deductions. To be eligible, employees must take six months or more to complete a training programme before starting full-time employment. This provision should be amended and offered to healthcare organisations (hospitals and diagnostic companies) for apprentice training of healthcare professionals.

Tax benefits on preventive health check-ups: Government should increase the health checkup deduction limit of ₹5,000 to ₹15,000 for a family in the budget 2022 to encourage citizens towards preventive health check-ups.

Incentivisation for digitisation in the healthcare sector: Providers who leverage the digital transformation journeys such as the adoption of telemedicine/virtual care solutions, referral management systems, personal health records/electronic health records (PHR/ EHR) could leverage the subsidies and/or indirect tax incentives for capital and operational expenses.

He further added that the country is recovering from the aftereffects of the pandemic and growing demand for healthcare services has underlined the need for more budgetary allocation in the healthcare sector to enhance the patient experience, attract smart investments in relevant digital health technologies, augment healthcare infrastructure, establish an ecosystem through collaboration, and develop an agile but robust governance structure

[ad_2]

Source link